Key Highlights

- Gold rallied above the $2,150 and $2,170 resistance levels.

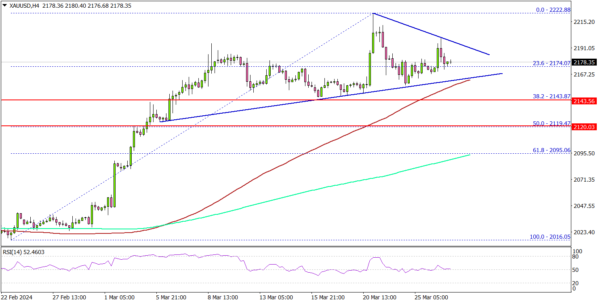

- A key contracting triangle is forming with support at $2,160 on the 4-hour chart.

- EUR/USD struggled to continue higher above the 1.0865 resistance.

- Bitcoin price regained strength for a move above the $70,000 resistance.

Gold Price Technical Analysis

Gold prices started a fresh increase from the $2,020 support against the US Dollar. The bulls cleared the $2,120 resistance to start a strong rally.

The 4-hour chart of XAU/USD indicates that the price settled above the $2,150 level, the 100 Simple Moving Average (red, 4 hours), and the 200 Simple Moving Average (green, 4 hours).

The bulls were able to pump the price above the $2,180 and $2,200 levels. Finally, the price traded close to the $2,225 level before the bears appeared. A high was formed at $2,222 and there was a minor downside correction.

There was a move below the $2,200 level. There was a spike below the 23.6% Fib retracement level of the upward move from the $2,016 swing low to the $2,222 high.

The first major support sits at $2,160. There is also a key contracting triangle forming with support at $2,160 on the same chart. Any more losses might call for a move toward the $2,142 level or the 50% Fib retracement level of the upward move from the $2,016 swing low to the $2,222 high.

On the upside, the price is facing resistance near the $2,190 level. The main resistance is now forming near $2,200, above which the price could accelerate higher toward $2,220.

Looking at Bitcoin, there was a strong upward move above the $70,000 zone but there are again signs of weakness.

Economic Releases to Watch Today

- Euro Zone Economic Sentiment Indicator for March 2024 – Forecast 96.3, versus 95.4 previous.