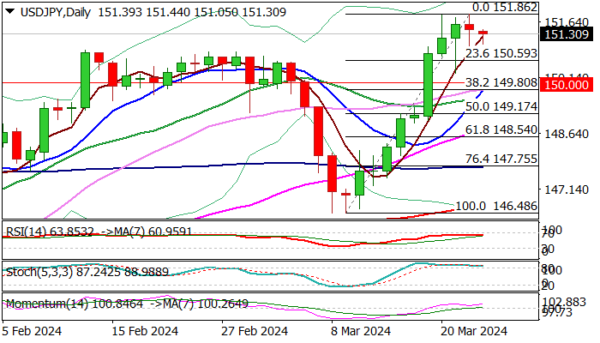

Bulls are taking a breather and consolidating just under key barriers at 150.90/94 (2023/22 tops) after strong rally in past two weeks.

USDJPY was inflated by a wide gap between US and Japan’s interest rates, with no positive impact from BoJ’s rate hike last week, as investors do not expect the central bank to be aggressive with policy tightening.

However, traders remain cautious regarding the latest warning from Japan’s officials that yen is too weak, which keeps possibility of intervention on the table.

Technical studies on daily chart are firmly bullish and supportive for fresh gains, with consolidation / correction on overbought conditions, to precede fresh push higher.

Initial support lays at 150.59 (Fibo 23.6% of 146.48/151.86 upleg, ahead of more significant 150.00/149.80 (psychological / Fibo 38.2%, reinforced by rising 10DMA) where extended dips should find firm ground to keep larger bulls in play and mark a healthy correction ahead of renewed attack at 151.90/94.

Res: 151.90; 151.94; 152.56; 153.00

Sup: 151.00; 150.59; 150.00; 149.80