- Fed and BoJ decisions have some impact on USDJPY

- Daily chart shows some weakness for the next few sessions

- But weekly chart looks strongly bullish

FOMC decision drives dollar lower

The dollar declined following the FOMC meeting on Wednesday, as Federal Reserve Chair Powell adopted a more accommodative stance. Policymakers have maintained the dot plot’s view for this year, which indicates a total of 75 basis points worth of interest rate reductions. That was sufficient to elicit a direct response in markets following the event.

Despite recent signs of persisting high inflation, Federal Reserve Chair Jerome Powell has indicated he will remain vigilant to ensure that inflation reaches the central bank’s desired target of 2%. Nevertheless, he mentioned that the presence of ongoing robustness in the job market should not serve as a deterrent for reducing interest rates.

BoJ helped USDJPY to move higher

Shifting to Tuesday’s BoJ decision, the Japanese central bank has made a significant change by initiating the winddown of huge monetary stimulus that has been in place for decades. This includes ending eight years of negative interest rates and other unconventional monetary policies. The Bank increased interest rates from -0.1% to a range of between 0% and 0.1%, marking the first-rate hike since 2007. This decision concludes eight years of negative rates and comes in response to the biggest jump in salaries in three decades and the achievement of the inflation target coming withing sight.

The yen depreciated by 1% versus the dollar following the decision made by the BoJ. This decline was expected by most investors, as they had previously factored in the possibility of a change. Analysts believe that the “dovish hike” further solidified the belief that the yen carry trade is still ongoing.

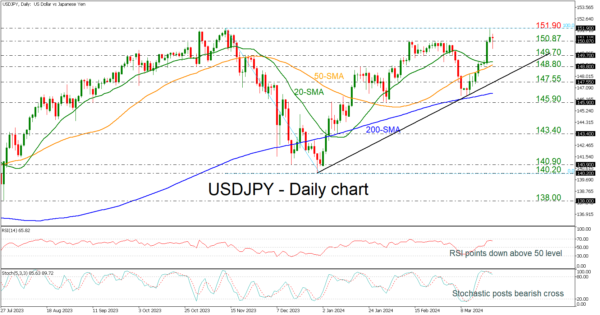

USDJPY in Daily chart

Looking the technical picture of USDJPY, the price failed to test again the previous peak of 151.90, achieved back on November 13 and some of the initial losses have been recouped. So the two policy meetings this week have had a contradicting effect on the pair. After the BoJ decision the pair reached the 150.87 resistance, extending the upside movement on Wednesday as well, until the Fed decision in the afternoon.

If the market continues the rebound off the medium-term ascending trend line, which has been drawn since December 28, then traders need to wait for a daily close above the 151.90 resistance to confirm another bullish wave. Even higher, the market may reach the next round numbers such as 153.00 and 154.00 until the 161.8% Fibonacci extension level of the down leg from 151.90 to 140.20 at 159.15.

However, a bearish retracement should not be excluded from the equation, as the technical oscillators are showing some negative signs. The RSI is pointing down, failing to climb above the 70 level, and the stochastic oscillator posted a bearish crossover within its %K and %D lines in the overbought territory, indicating a correction to the downside.

Any declines could drive the pair towards the next immediate support lines of 150.87 and 149.70 before challenging the 20- and the 50-day simple moving averages (SMAs) around the 149.00 handle. Even if the price touches the ascending trend line the broader outlook would remain positive and only a drop beneath the 200-day SMA at 146.64 may change the view to a more neutral one.

Bigger picture in weekly chart

In the weekly chart, there are no signs for a downward movement and the price is still holding well above the long-term rising trend line. The RSI indicator is heading north above the neutral threshold of 50 and the stochastic is ticking higher, ready to post a bullish cross with the two lines. The SMAs are rising and following the current market reaction. In this bigger picture, a change of the outlook would come if there were fall beneath the 140.20 support line.