- WTI crude oil looks positive despite the latest drop

- 20- and 200-day SMAs post bullish cross

- MACD and RSI show positive signs

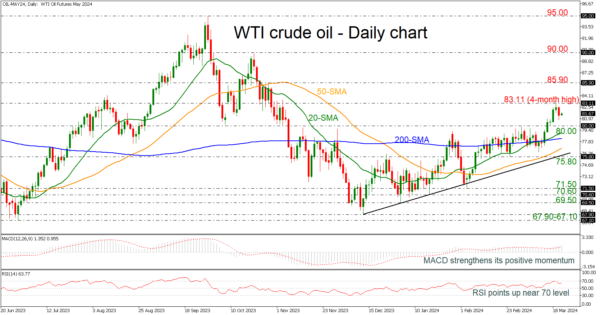

WTI crude oil futures are easing after the climb towards the new four-month high of 83.11 but the broader outlook remains bullish, especially after the rally above the 80.00 round number.

According to technical oscillators, the MACD is extending its positive momentum above its trigger and zero lines, while the RSI is pointing slightly up near the 70 threshold. Also, the 20- and the 200-day simple moving averages (SMAs) posted a golden cross, confirming the upside structure.

If the market continues to fall, immediate support for traders to have in mind is the 80.00 mark ahead of the 20- and the 200-day SMAs currently at 79.00 and 78.20 respectively. Beneath these lines, the 50-day SMA at 76.87 and the short-term uptrend line around the 75.80 support may halt bearish actions.

In the positive scenario, a jump beyond the 83.11 resistance may drive the price towards the 85.90 barricade before meeting the 90.00 handle, switching the medium-term outlook to a more bullish one.

To sum up, WTI crude oil has been developing in an ascending tendency since December 13 and only a dive below the rising trend line may change the current trend.