- Gold (XAU/USD) has traded in a tight range of 2% in the past two weeks after it printed a fresh all-time high of US$2,195 on 8 March.

- The biggest risk event for today will be the latest Fed FOMC’s dot plot projection on the trajectory of its Fed funds rate; a reduction to two cuts from three cuts for 2024 cannot be ruled out.

- Technical analysis suggests potential short-term weakness in Gold (XAU/USD).

- Watch the key short-term resistance at US$2,180 on Gold (XAU/USD).

The price actions of Gold (XAU/USD) have staged the expected bullish breakout and rallied by +7.4% to print a new fresh all-time high of US$2,195 on 8 March.

In the past two weeks, the price actions of Gold (XAU/USD) have started to consolidate ahead of today’s major risk event, the US central bank, FOMC monetary policy decision outcome, latest “dot plot projections”, and Fed Chair Powell press conference.

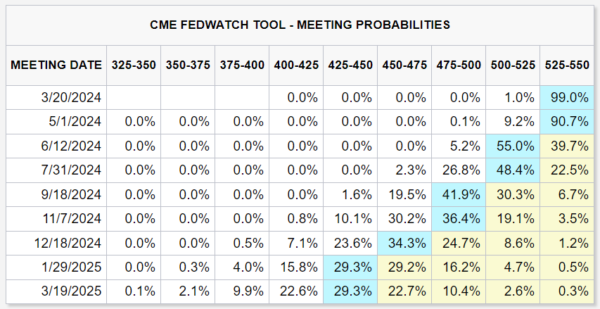

The US monetary policy outcome will likely be a non-event as market participants have been “guided” by the latest slew of Fed Speak as well as a not-so-soft inflationary trend (February’s CPI and PCE data) in the US to price in a no-change to the Fed funds rate at 5.25%-5.50% for the 6th consecutive meeting as indicated by the CME FedWatch tool with a 99% probability of such an outcome.

Fed funds rate futures is still pricing a total of three cuts for 2024

Fig 1: Fed FOMC meeting probabilities as of 20 Mar 2024 (Source: CME FedWatch Tool, click to enlarge chart)

The biggest risk will be a change to the dot-plot projection of the forecasted trajectory of Fed funds rate for 2024; in the previous dot-plot released during the December 2023 FOMC meeting, three cuts have been pencilled in which is now in line with market participants’ expectations as priced by the CME FedWatch Tool. It now reflects only three interest rate cuts by the Fed before 2024 ends, down from six cuts at the start of 2024.

If the latest Fed officials’ median projection on the trajectory of the Fed funds rate for 2024 indicates a reduction to two cuts from three (below market expectations) which in turn may trigger a further potential rebound in the US 10-year Treasury yield to surpass the 4.3% level.

This scenario is likely to be detrimental for Gold at least in the short-term because the opportunity costs for holding Gold increase as it is “a zero-yielding asset”.

A minor corrective pull-back may be in play for Gold

Fig 2: Gold (XAU/USD) major trend as of 20 Mar 2024 (Source: TradingView, click to enlarge chart)

Fig 3: Gold (XAU/USD) short-term trend as of 20 Mar 2024 (Source: TradingView, click to enlarge chart)

Technically speaking, the price actions of Gold (XAU/USD) are still evolving within a major uptrend phase in place since the 28 September 2022 low of US$1,615 supported by an upward trajectory of the Gold/Copper ratio (see Fig 2).

In the lens of technical analysis, price actions of highly liquid tradable instruments do not move vertically up or down but oscillate within a trending phase.

In the short term, Gold (XAU/USD) has started to turn “soft” after a rapid rally from 23 February to 8 March, and price actions have been capped by a minor descending trendline in the past week.

In addition, the hourly RSI momentum indicator has just staged a bearish momentum breakdown from its parallel ascending support at the 43 level which translates to further potential weakness in price action (see Fig 3).

Watch the US$2,180 short-term pivotal resistance for Gold (XAU/USD), a break below the US$2,146 near-term support may see further weakness to expose the next intermediate supports at US$2,125 and US$2,110 (also the upward-sloping 20-day moving average).

On the flip side, a clearance above US$2,180 invalidates the corrective pull-back scenario to kickstart another bullish impulsive sequence for the next intermediate resistance to come in at US$2,200/210 in the first step.