Key Highlights

- Bitcoin price started a downside correction below $70,000 and $68,000.

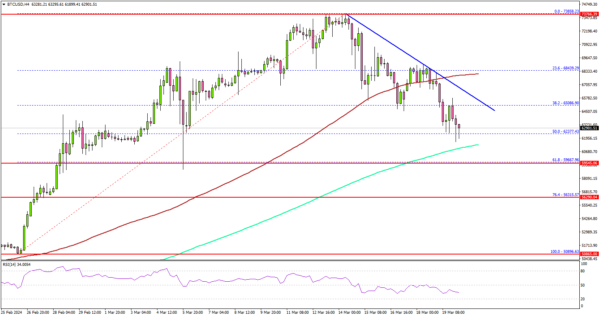

- A key bearish trend line is forming with resistance at $65,800 on the 4-hour chart.

- USD/JPY rallied following the Bank of Japan’s (BoJ) first historic interest rate hike.

- EUR/USD and GBP/USD also saw bearish moves.

Bitcoin Price Technical Analysis

Bitcoin price started a downside correction from the $73,850 zone. BTC traded below the $70,000 and $68,000 support levels to move into a short-term bearish zone.

Looking at the 4-hour chart, the price settled below the $66,500 level, and the 100 simple moving average (red, 4 hours). The price declined below the $65,000 support and tested the 50% Fib retracement level of the upward move from the $50,896 swing low to the $73,858 high.

The price is now testing the $62,500 support zone. The next major support is near the 200 simple moving average (green, 4 hours) at $61,500.

Any more losses might send the price toward the $60,000 support zone or the 61.8% Fib retracement level of the upward move from the $50,896 swing low to the $73,858 high.

Immediate resistance is near the $64,500 level. The next resistance is near $66,000. There is also a key bearish trend line forming with resistance at $65,800 on the same chart. The main resistance could be $68,000 and the 100 simple moving average (red, 4 hours).

A successful close above the 100 simple moving average (red, 4 hours) might start another steady increase. In the stated case, the price may perhaps rise toward the $72,000 level.

Economic Releases

- Fed Interest Rate Decision – Forecast 5.5%, versus 5.5% previous.