- GBPJPY trades higher and hits resistance near 191.30

- Remains in uptrend despite BoJ decision

- MACD and RSI detect positive momentum

- For the outlook to change, a dip below 187.95 may be needed

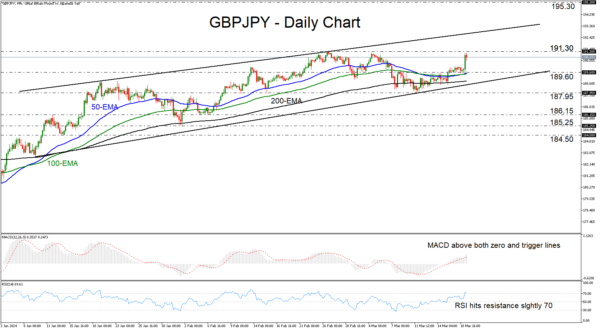

GBPJPY traded higher yesterday, but hit resistance near the 191.30 barrier today, marked by the high of February 26, and pulled back somewhat. Even after the BoJ took interest rates out of negative territory and abandoned yield curve control, the pair remains in an uptrend as denoted by the upward sloping trendline drawn from the low of January 9.

The short-term oscillators detect positive momentum corroborating the bullish outlook. The MACD is running above both its zero and trigger lines, while the RSI is lying within its above-70 zone, although it ticked down today. This means that some further retreat may be on the cards before the next leg north.

The bulls could take charge again from near the 189.60 zone, which coincides with the 50- and 100-period exponential moving averages (EMAs), and they may drive the action above 191.30, entering territories last tested in August 2015. The next resistance obstacle may be the upward sloping resistance line drawn from the high of January 19, but if traders are willing to overcome that line as well, they could take the pair all the way up to the 195.30 area, which acted as a ceiling during the whole summer of 2015.

For the near-term picture to shift to bearish, a decisive dip below 187.95 may be needed. Such a move will take GBPJPY below all the plotted moving averages and below the uptrend line taken from the low of January 9. The bears may then get encouraged to dive towards the 186.15 zone that offered support between February 5 and 7.

To sum up, GBPJPY remains in an uptrend despite the BoJ hiking interest rates and abandoning yield curve control. A break above 191.30 will confirm a higher high and take the pair into territories last tested in 2015.