- Gold pulls back from its recent record peak

- Momentum indicators exit overbought conditions

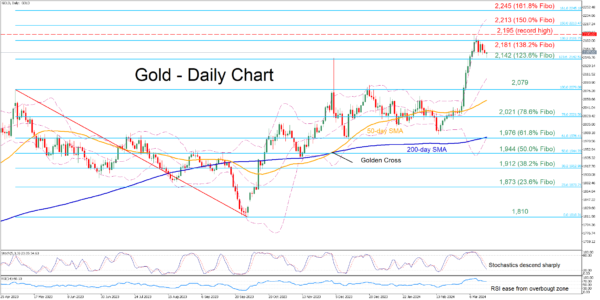

Gold experienced a massive surge following its profound break above the 50-day simple moving average (SMA), posting a fresh all-time high of 2,195 on March 8. However, bullion has been undergoing a minor downside correction since then as it had approached extremely overbought conditions.

Should the pullback extend, the November peak of 2,142, which coincides with the 123.6% Fibonacci extension of the 2,079-1,810 downleg, could act as the first line of defence. Further declines could then come to a halt at 2,079, a region that provided resistance both in April and December 2023. Even lower, the 78.6% Fibo of 2,021 might provide downside protection.

On the flipside, if the price erases its recent setback and marches higher, initial resistance could be found at the 138.2% Fibo of 2,181 ahead of the all-time peak of 2,195. A violation of that zone could pave the way for the 150.0% Fibo of 2,213.

In brief, gold has been experiencing a pullback from its record high after reaching extremely overbought conditions. Should the price break below the 123.6% Fibo of 2,142, the decline could accelerate as there is no prominent support until the 2,080 region.