- WTI crude rebounds off 200-day SMA

- Remains in an uptrend in the short-term

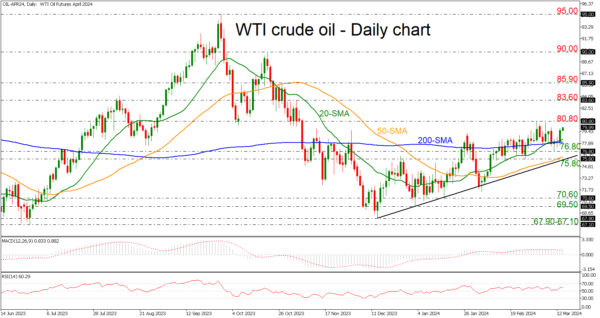

WTI oil futures are finding a strong support level near the 200-day simple moving average (SMA) at 78.00 and are also struggling to jump beyond the 80.80 resistance. The price has been in an uptrend since mid-December with the technical oscillators suggesting a neutral to bullish bias. The RSI is pointing north above the 50 territory, while the MACD is moving sideways below its trigger line and above the zero level.

If the market manages to pick up speed, the 80.80 level could offer nearby resistance ahead of the 83.60 barricade. A significant close above the latter would break the 85.90 hurdle, raising chances for further increases.

Should prices decline, immediate support could be found around the 200-day SMA at 78.00, an area which has provided both resistance and support from January to March. Then a leg below that level, the price could meet the 75.80-76.80 support, which encapsulates the short-term ascending trend line. A drop lower could change the outlook to a neutral one, hitting 70.60.

In a nutshell, WTI crude oil is moving horizontally in the very short-term view, but an increase above 80.80 could endorse the longer-term bullish outlook.