Key Highlights

- USD/JPY started a major decline from the 150.80 resistance zone.

- It traded below a key bullish trend line with support at 150.00 on the 4-hour chart.

- Gold prices surged above the $2,120 resistance zone.

- The nonfarm payrolls could change by 200K, down from 353K.

USD/JPY Technical Analysis

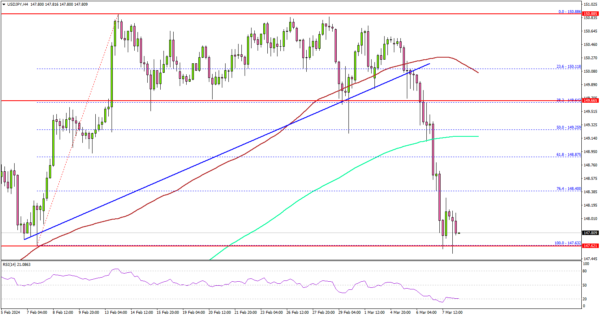

The US Dollar struggled to clear the 150.80 resistance zone against the Japanese Yen. USD/JPY started a major decline after it settled below 150.00.

Looking at the 4-hour chart, the pair settled below the 150.00 level, the 100 simple moving average (red, 4-hour), and the 200 simple moving average (green, 4-hour). It also traded below a key bullish trend line with support at 150.00.

The bears took control and dumped the pair below the 148.80 support zone. There was a clear move below the 76.4% Fib retracement level of the upward move from the 147.63 swing low to the 150.88 high.

Immediate support is near the 147.60 level. The next major support is at 147.20. If there is a downside break below the 147.20 support, the pair could decline toward the 146.00 support.

If there is a recovery wave, the pair could face resistance near the 148.20 level. The first major resistance is now forming near the 148.80 level and the 200 simple moving average (green, 4-hour). The main resistance is near 149.20. A close above the 149.20 zone could open the doors for more upsides. The next stop for the bulls might be 150.00.

Looking at Gold, there was a strong increase above the $2,120 resistance and the bulls might aim for a move toward $2,180.

Economic Releases

- US nonfarm payrolls for Feb 2024 – Forecast 200K, versus 353K previous.

- US Unemployment Rate April 2024 – Forecast 3.7%, versus 3.7% previous.