AUDUSD advances for the second day, underpinned by weaker US dollar and higher iron ore prices.

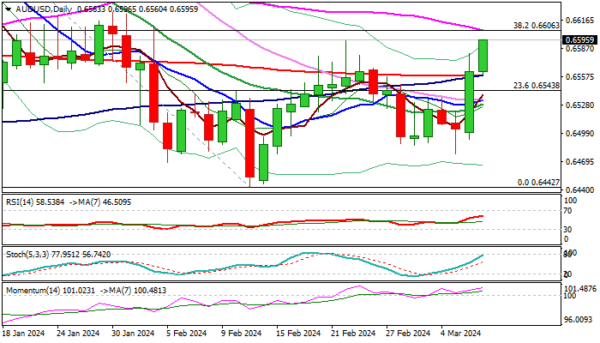

The pair hit two-week high and pressure key barriers at 0.6600 zone (near-term range top / Fibo 38.2% of 0.6871/0.6442 descend / 55DMA).

Sustained break here is needed to signal an end of sideways phase and continuation of recovery from 0.6442 (2024 low, posted on Feb 13) and open way for attack at daily cloud (spanned between 0.6642 and 0.6685) and 0.6707 (Fibo 61.8% of 0.6871/0.6442) in extension.

Immediate bullish bias expected to remain in play while broken 200DMA (0.6559) holds

Improving daily studies support the action, as positive momentum strengthens and MA’s turned to bullish setup, with break above converged 100/200 DMA’s (on track to make bull-cross) to additionally boost bulls.

Better than expected economic data from Australia and China are supportive for the Aussie dollar, while the greenback came under increased pressure from relatively dovish remarks from Fed Powell.

Res: 0.6606; 0.6624; 0.6642; 0.6685.

Sup: 0.6559; 0.6543; 0.6526; 0.6492.