- USDJPY is edging aggressively lower today and closing in on a key support area

- This is the bears’ first attempt to push USDJPY significantly below the 150 level

- Momentum indicators support the current correction

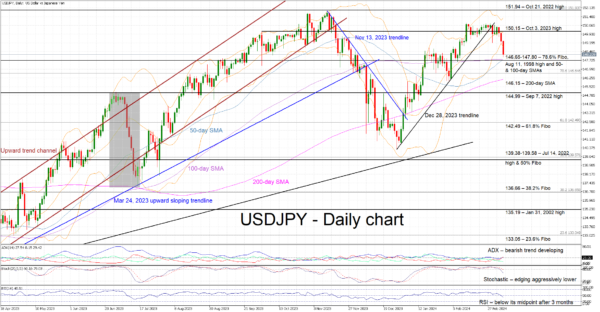

USDJPY is recording its third consecutive red candle as recent comments by BoJ members are potentially opening the door to a monetary policy move in the upcoming gathering. USDJPY has managed to drop below the 150 threshold and is getting closer to the busy 146.65-147.80 support area.

In the meantime, the momentum indicators are supportive of the correction. More specifically, the Average Directional Movement Index (ADX) climbed above the 25 threshold and is thus signalling a developing bearish trend in USDJPY. Similarly, the RSI has dropped below its 50-midpoint for the first time in more than 3 months. More importantly, the stochastic oscillator has broken below its overbought (OB) territory and is edging aggressively lower.

Should the bulls remain patient, they could try to regain market control and lead USDJPY again higher towards the October 3, 2023 high at 150.15. If successful, they could then stage a rally towards the October 21, 2022 high at 151.94 and potentially open the door to a new 30-year high.

On the flip side, the bears are keen for the current correction to continue and are possibly preparing to test the support set by the 146.65-147.80 area, which is populated by the 78.6% Fibonacci retracement of the October 21, 2022 – January 16, 2023 downtrend, the August 11, 1998 high, and the 50- and 100-day simple moving averages (SMAs). Even lower, the bears could push USDJPY towards the 144.99 level, provided they overcome the 200-day SMA at 146.15.

To sum up, USDJPY is edging aggressively lower with the bears hoping that the current correction continues with some help from the momentum indicators.