- Canadian economy set to return to growth but remain sluggish

- Will the Loonie be able to capitalize on any good news?

Canadian economy to avoid recession once again

The Canadian dollar has barely made any serious progress against other major currencies this year besides the battered Japanese yen. Canadian Q4 GDP data may not come to the rescue on Thursday to give the much-needed boost, but investors will still look for any signs rate cuts will be necessary sooner than later.

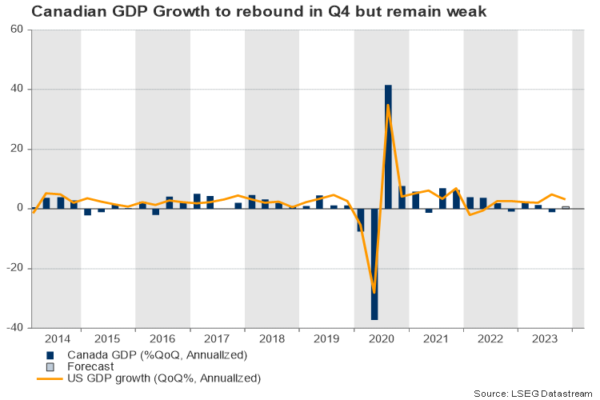

The Canadian economy experienced a mild quarterly contraction of 0.3% in the three months to September and shrank by 1.1% in annualized terms on the back of falling exports and muted household spending. While a technical recession would have been the case, an upward revision in the second quarter data did not meet the rule of “two consecutive negative quarters”.

Analysts believe that the economy escaped a recession in the last quarter too, finishing the year 0.8% stronger in annualized terms. Such news would bring some relief to analysts, but perhaps only temporarily, as the overall economic picture would still remain fragile.

Canada vs US

Compared to its US cousin, Canada has been facing choppier growth, probably because of the relatively tighter fiscal spending, which Biden’s administration enhanced significantly to boost production incentives, especially in the semiconductor industry through its CHIPS act. Perhaps Trudeau’s administration might also seek more fiscal engagement when the 2025 election season starts to heat up.

Moreover, Canadian mortgage holders can enjoy fixed interest rates for a period of no more than five years, which makes them more vulnerable to rate changes. On the other hand, their US counterparts are allowed to pay steady borrowing costs for the entire term of the mortgage, which can last up to thirty years.

Last but not least, the Canadian economy is smaller and more exposed to international trade, with exports and imports accounting for more than 60% of its GDP compared to the US’s 25%. Hence, businesses might be more conservative with their future investment plans as their second-best trade partner, China, might have a bumpy road ahead and the European Union might keep struggling with a changing geopolitical landscape.

Hence, with the headline CPI inflation having slipped below 3% and back into the BoC’s range target of 1-3%, investors might think that lower interest rates will arrive earlier in Canada than in other major economies, especially if economic growth remains stagnant.

Inflation falls into the BoC range target, but confirmation needed

Yet, the decision of rate cuts may not be straightforward for the central bank. January’s CPI data showed that underlying inflation was still above 3.0% y/y, while shelter prices continued to grow by more than 6% y/y. Therefore, given the pickup in wage growth, premature rate cuts could cause an inflation resurgence. Note that futures markets are currently eyeing 69bps of rate cuts throughout 2024. The odds are relatively higher in the second half of the year but show no confidence for any meeting.

USDCAD levels to watch

Meanwhile in FX markets, the loonie has already given up half of its November-December gains against the greenback, falling to a new two-month low of 1.3600 per US dollar earlier today. Stronger-than-expected GDP prints might provide a helping hand to the loonie, though any potential gains might be short-lived as inflation is still the only game in town.

Technically, USDCAD could extend its uptrend towards the 1.3622 resistance area, a break of which might trigger an aggressive rally towards the 1.3700 round level. Otherwise, the pair could flip backwards to test the 1.3537-13515 support region ahead of its 20- and 200-day simple moving averages (SMAs). The 1.3410-1.3460 restrictive zone could be the next destination on the downside.