- EURGBP looks for resistance at 50-day SMA

- RSI confirms sideways move

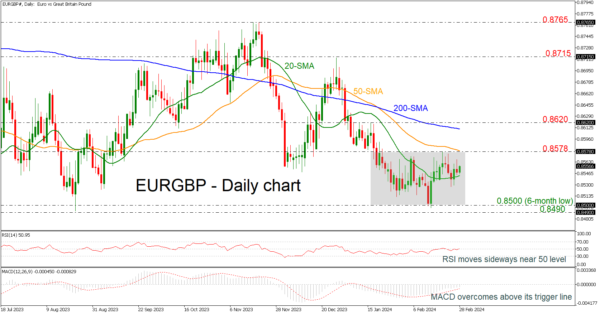

EURGBP has been consolidating beneath the 50-day simple moving average (SMA), which overlaps with the 0.8578 resistance level and the six-month low of 0.8500 since January 18.

According to technical oscillators, the RSI is confirming the sideways movement as it is holding near the neutral threshold of 50, while the MACD is standing above its trigger line but still beneath the zero level.

If the market remains above the 20-day SMA then the next target could come from the upper boundary of the current short-term trading range at 0.8578 ahead of the 200-day SMA at 0.8610. Marginally higher, the 0.8620 resistance may halt bullish actions, acting as a turning point for more losses.

On the other hand, a decline could last until the 0.8500 critical level, while a dive below 0.8490 could open the way for steeper bearish movements.

All in all, EURGBP is looking neutral in the near-term but the medium-term timeframe is still negative and only a successful attempt above the 200-day SMA may switch the outlook to a bullish one.