- USDJPY stuck in a tight range in the past few sessions

- The pair is within breathing distance from 2023 peak

- Momentum indicators soften but remain positive

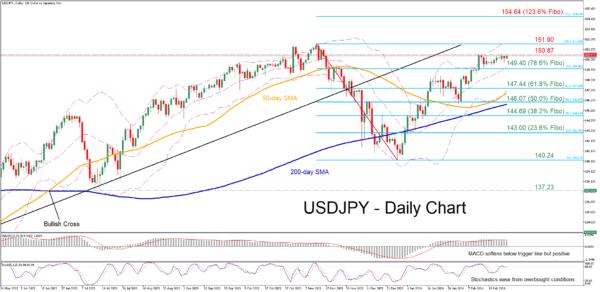

USDJPY has been in a steady uptrend since late 2023, forming a V-shaped recovery from its November-December rout. Moreover, in the past few sessions, the pair has been trading sideways near its 2024 peak of 150.87, a tad below its 33-year high of 151.94 registered in October 2022.

Should bullish pressures persist, the price might revisit its recent three-month peak of 150.87. Conquering this barricade, the bulls could attack the 2023 high of 151.90, which lies marginally below the 33-year peak of 151.94. Further advances could then cease at 154.64, which is the 123.6% Fibonacci extension of the 151.90-140.24 downleg.

On the flipside, bearish actions may send the price lower to test the 78.6% Fibo of 148.40. A violation of that territory could pave the way for the 61.8% Fibo of 147.44. Failing to halt there, the pair could descend towards the 50.0% Fibo of 146.06, which provided support in early February.

Overall, USDJPY has been trading sideways near its 2024 peak amid weakening positive momentum. Should the pair claim this barrier, there is no prominent resistance before the 33-year peak of 151.94.