WTI oil price fell further in early Monday trading, in extension of Friday’s 2.2% drop, as the sentiment soured on signals that higher than expected US inflation may delay Fed rate cuts.

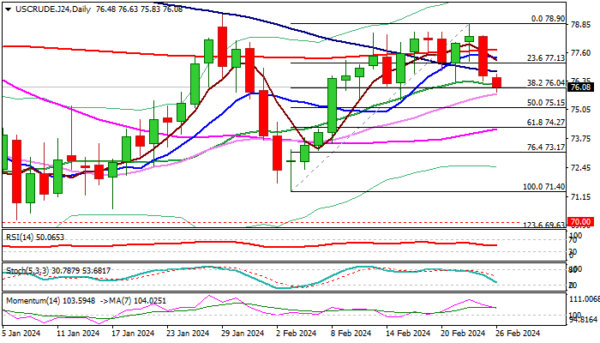

Fresh weakness emerged after several upside rejections and repeated failure to register a weekly close above important Fibo resistance at $78.13 (38.2% retracement of $95.00/$67.70 downtrend), which left a platform at $78.50/90 zone.

Near-term structure weakened as the price broke below a cluster of converged daily MA’s (200/10/100/ 20) and bullish momentum is fading, with formation of bearish engulfing pattern on weekly chart, adding to negative signals.

Bears cracked pivotal Fibo support at $76.04 (38.2% of $71.40/$78.90) with close below this level to further boost fresh bears for attack at $75.34/15 (daily Kijun-sen / 50% retracement) loss of which to confirm reversal.

Falling 10DMA ($76.75) offers solid resistance which should keep the upside protected and keep near-term bears intact.

Res: 76.99; 77.65; 78.50; 79.27.

Sup: 76.17; 75.81; 74.97; 74.12.