Gold stands at the front foot at the start of the week and holds near two-week high ($2041) posted on Friday.

Growing tensions in the Middle East and overall negative geopolitical picture, continue to fuel safe haven demand and boost metal’s price, along with neutral / negative near-term outlook for the US dollar.

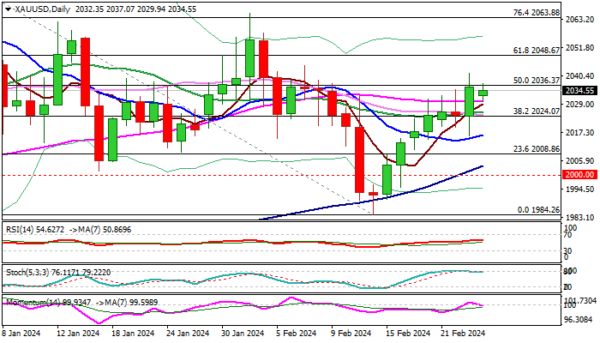

Technical picture on daily chart is improving, as moving averages turned to full bullish configuration, though overbought stochastic and flat momentum requires caution.

Last week’s gains completed reversal pattern on weekly chart, adding to positive signal, which looks for verification on sustained break of cracked $2036 pivot (50% retracement of $2088/$1984 / 10WMA).

Near-term bias is expected to remain with bulls while the price stays above $2024 (daily Kijun-sen / broken Fibo 38.2%) and keep in focus next target at $2048 (Fibo 61.8%), guarding $2065 (Feb 1 high).

Markets await release of key US economic indicators this week (Q4 GDP on Wednesday and PCE price index on Thursday) which are expected to provide more details about Fed’s next steps regarding interest rates and generate fresh direction signals.

Res: 2041; 2048; 2057; 2065.

Sup: 2024; 2016; 2008; 2003.