Key Highlights

- EUR/USD is attempting a fresh increase toward the 1.0930 resistance.

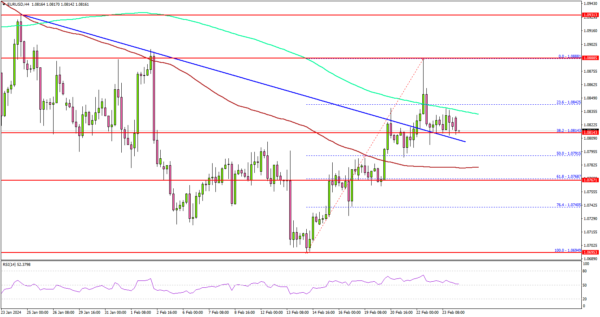

- It broke a major bearish trend line with resistance at 1.0815 on the 4-hour chart.

- GBP/USD is consolidating above the 1.2620 support.

- Gold price is facing resistance near the $2,040 level.

EUR/USD Technical Analysis

The Euro started a decent increase from the 1.0700 zone against the US Dollar. EUR/USD gained pace for a move above the 1.0780 and 1.0800 resistance levels.

Looking at the 4-hour chart, the pair traded above a major bearish trend line with resistance at 1.0815. There was a move above the 1.0850 level, but the bears faced resistance near the 1.0885 level. A high was formed near 1.0888 and the pair is now well above the 100 simple moving average (red, 4-hour).

However, the pair failed to settle above the 200 simple moving average (green, 4-hour). On the upside, the pair is facing resistance near the 1.0840 level.

A close above the 1.0840 zone could open the doors for more upsides. The next stop for the bulls might be 1.0885. Any more gains might send EUR/USD toward 1.0930.

Immediate support is near the 1.0800 level. The first major support sits near the 1.0780 level and the 100 simple moving average (red, 4-hour). The next major support sits at 1.0765, below which the pair might gain bearish momentum. In the stated case, the pair could even visit the 1.0720 support level.

Looking at Gold, the bulls are attempting a fresh increase but they are facing hurdles near the $2,040 level.

Economic Releases

- US New Home Sales for Jan 2024 (MoM) – Forecast +1.8% versus +8.0% previous.