- USDCAD lacks strength but holds near key support zone

- Short-term bias looks neutral

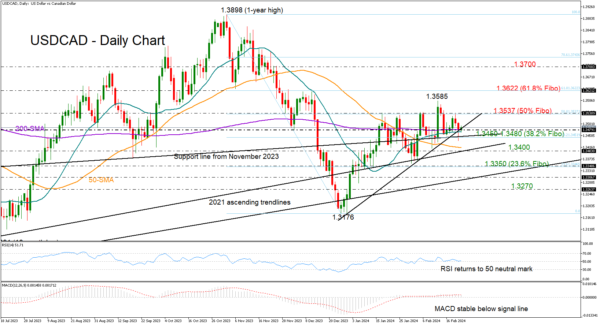

USDCAD has been facing difficulties in printing new higher highs for more than a week now, shifting to the sidelines to trade around 1.3480.

The technical indicators are mirroring the absence of buying interest, with the RSI easing towards its 50 neutral mark and the MACD remaining muted below its red signal line. The flattening simple moving averages (SMAs) is another indication of an indecisive market.

On a positive note, the price has not dropped below the protective trendline zone of 1.3450-1.3480 yet, and if that floor holds firm again, the pair might crawl up to retest the 50% Fibonacci retracement of the previous downleg at 1.3537. A successful move higher would re-activate the short-term uptrend, bringing the 61.8% Fibonacci of 1.3622 next into view.

In the bearish scenario, where the bears take control below 1.3450, support could develop around the 1.3400 mark. This is where the 50-day SMA and the ascending trendline from 2021 are converging. Hence, another failure there might prompt a decline towards the 1.3300-1.3350 territory. Should that base crack too, the pair could tumble towards December’s bottom of 1.3176, unless the 1.3270 constraining zone comes to the rescue beforehand.

Summing up, USDCAD keeps trading within a neutral territory in the short-term picture. A step below 1.3450 could dampen sentiment, whilst a bounce above 1.3537 could bolster buying appetite.