- GBPUSD holds above key support trendline despite disappointing UK GDP data

- Short-term trend deteriorates, but confirmation needed below 1.2500

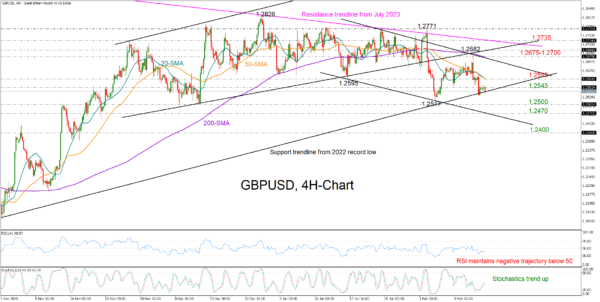

GBPUSD remained squeezed between the 1.2563 resistance and the key support trendline from the 2022 record low in the four-hour chart despite the UK economy falling into a mild technical recession in Q4 2023.

The market trend is leaning on the downside as the price has already printed a lower low at 1.2517 and a lower high at 1.2682. On the other hand, the technical indicators are sending mixed signals, with the RSI maintaining its negative trajectory below its 50 neutral mark and the stochastic oscillator sloping upwards.

If the price closes below 1.2550 in the coming hours, sellers could next target the 1.2500 round level. A break lower would confirm a negative trend reversal, pressing the price towards the lower boundary of the short-term bearish channel at 1.2470. If the decline continues from there, the door will open for the 1.2400 mark.

On the upside, a step above 1.2563 could immediately halt near the 20- and 50-period simple moving averages (SMAs) at 1.2595. Should the bulls jump that wall, the pair could accelerate towards the 200-period SMA at 1.2675, while an extension above the broken ascending trendline from mid-December could face a test around the critical 2023-2024 resistance trendline at 1.2735.

In summary, GBPUSD is maintaining a cloudy outlook in the short-term picture, with sellers awaiting a clear misstep below 1.2550 to press the price lower.