- GBPUSD tests the support set by the 200-day SMA

- Bears are attempting a breakout from the recent trading range

- Momentum indicators tentatively support the correction

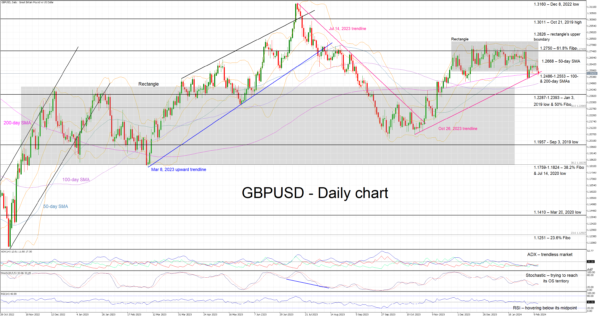

GBPUSD is registering its second consecutive red candle as the bears are trying to push GBPUSD below its recent trading range following yesterday’s US CPI release. The 200-day simple moving average (SMA) and the October 26, 2023 ascending trendline are acting as strong support points at this moment, testing the bear’s determination.

Momentum indicators appear to tentatively be on the bears’ side. The RSI is trading below its midpoint and possibly preparing to drop to the lowest point since mid-October. Similarly, the stochastic oscillator is trying to edge below its moving average and then set course towards its oversold territory. Only the Average Directional Movement Index (ADX) seems uninterested in the current movement as it remains stuck below its 25-midpoint and thus pointing to a trendless market.

Should the bears stay determined, they could try to push GBPUSD below both the October 26, 2023 trendline and the 1.2486-1.2553 range that is populated by the 100- and 200-day SMAs. Lower, the busy 1.2287-1.2393 area, which is defined by the January 3, 2019 low and the 50% Fibonacci retracement of the June 1, 2021 – September 26, 2022 downtrend, will probably prove stronger to overcome than currently envisaged.

On the flip side, the bulls are probably keen to defend the 1.2486-1.2553 range and gradually lead GBPUSD back inside the recent rectangle. The 50-day SMA at 1.2668 could momentarily trouble the bulls with their next target possibly being the 61.8% Fibonacci retracement level at 1.2750. Even higher, the upper boundary of the recent rectangle at 1.2826 is the last obstacle before recording a bullish breakout.

To conclude, GBPUSD bears are trying to benefit from the recent bullish US data, but they have to cross some key levels without the strong support of the momentum indicators.