The US Dollar Index (DXY) has been in a consolidation phase since early February, displaying minor signs of weakening last week. Despite this, the USD continues to find support around the 104.00 mark on dips, indicating a general resilience. Analysis suggests that the USD may currently be overvalued in the short term when considering various factors such as spreads. Moreover, US yields have remained relatively stagnant, limiting the potential for the USD to strengthen without significant economic data improvements. Market sentiment is awaiting the release of the US January CPI report, which is expected to influence the USD’s short-term trajectory. Depending on whether inflation is slower or sticks close to expectations, the USD’s direction could vary, potentially impacting market expectations regarding future Federal Reserve actions. In essence, while the USD remains somewhat stable, its near-term movement hinges on upcoming economic data releases.

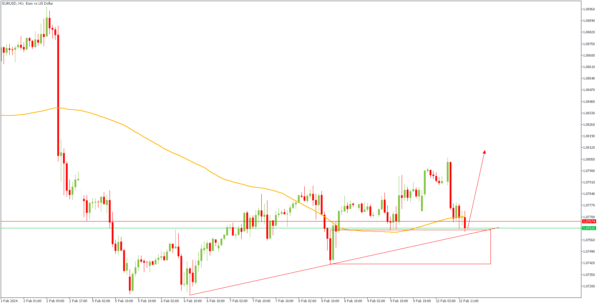

EURUSD – H1 Timeframe

On the 1-hour timeframe, EURUSD is currently being supported by the trendline, 100-period moving average,as well as the demand zone – all of which indicate the possibility of a bullish continuation from the current zone.

Analyst’s Expectations:

- Direction: Bullish

- Target: 1.07997

- Invalidation: 1.07408

GBPUSD – H1 Timeframe

In a similar manner to what we already analyzed on the EURUSD chart, the hourly timeframe chart of GBPUSD is also trading within the demand zone at the moment with crucial support from the trendline, 100-period moving average, and the demand zone as well.

Analyst’s Expectations:

- Direction: Bullish

- Target: 1.26456

- Invalidation: 1.25989

AUDUSD – H1 Timeframe

AUDUSD is in alignment with the views on GBPUSD and EURUSD as afore-mentioned. I see the likelihood of price bouncing off the trendline support, moving average support, and the demand zone.

Analyst’s Expectations:

- Direction: Bullish

- Target: 0.65270

- Invalidation: 0.65032

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.