- GBPUSD rests near the 20-period SMA

- RSI and MACD suggest bearish wave

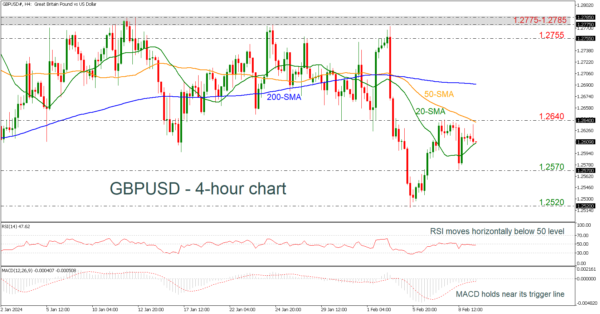

GBPUSD is falling after a bullish spike earlier today, testing the 20-period simple moving average (SMA) in the 4-hour chart.

According to technical oscillators, the RSI is still standing below its 50 neutral mark, losing some pace, and the MACD oscillator has yet to confirm a bearish crossover within its trigger line in the negative territory, both keeping the bias on the downside for now.

In the negative scenario, the 20-period SMA at 1.2605 has been guarding selling forces. Hence, a step beneath that line at 1.2570 might produce fresh negative volatility, likely squeezing the price towards the 1.2520 support level, taken from the lows on February 5.

In the event the pair re-activates its uptrend above the 1.2640 resistance, which coincides with the 50-period SMA, the next target will be the 200-period SMA at 1.2690. Even higher, the bulls might head for the 1.2755, which was a key resistance area during January.