- EURJPY bounces back after 50-day SMA prevents decline

- But reverses lower again, finding support at descending trendline

- Momentum indicators are neutral-to-negative

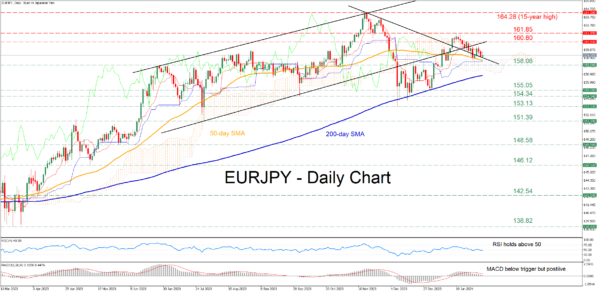

EURJPY has been sliding lower in the short term, following its rejection at 161.85 in late January. Despite its temporary rebound at the 50-day simple moving average (SMA), the pair has been on the retreat again, holding marginally above the downward sloping trendline taken from its 15-year peak of 164.28.

Should selling pressures persist, the price could initially test the February support of 158.06. Further declines could then come to a halt at the January low of 155.05 ahead of the October support of 154.34. Even lower, the December bottom of 153.13 could provide downside protection.

Alternatively, if buyers re-emerge and propel the price higher, immediate resistance could be found at 160.80, which overlaps with the lower boundary of the pair’s ascending channel. Jumping above that territory, the price may revisit the January high of 161.85. A break above that area could pave the way for the 15-year peak of 164.28.

In brief, despite attempting to pause its short-term selloff, EURJPY remains under significant downside pressure. Hence, a break below the descending trendline currently in place could accelerate the decline.