- NZDUSD extends its bearish leg below 200-day SMA

- But manages to rebound strongly from 2-month bottom

- Oscillators remain tilted to the downside

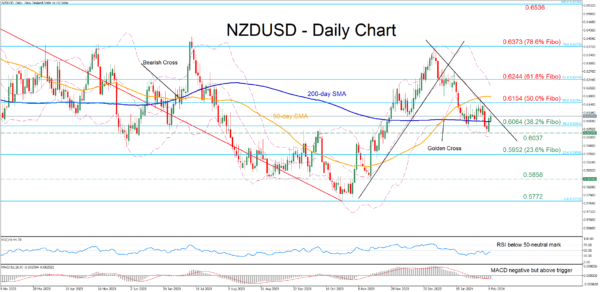

NZDUSD has been in a steady downtrend since its rejection from near 0.6373 in late December, which is the 78.6% Fibonacci retracement of the 0.6536-0.5772 downleg. This week, the pair dropped to a fresh two-month low after violating its 200-day simple moving average (SMA), but the bulls fought back and reclaimed the latter.

Given that both the RSI and MACD are within their negative zones, the price might revisit its 200-day SMA, currently at 0.6082. Diving beneath that floor, the pair could challenge the 38.2% Fibo of 0.6064 ahead of the recent two-month bottom of 0.6037. A violation of that region could pave the way for the 23.6% Fibo of 0.5952.

On the flipside, should the recovery persist, immediate resistance could be found at the 50.0% Fibo of 0.6154. Further advances could then cease around the 61.8% Fibo of 0.6244. Breaking above that hurdle, the price might ascend towards the 78.6% Fibo of 0.6373, a region that capped the pair’s advance in December.

Overall, despite NZDUSD’s slide below the crucial 200-day SMA, the bulls managed to strike back and reclaim that barricade. For the rebound to resume, the price needs to break above the downward sloping trendline that connects its lower highs since December.