- USDJPY is in the red again today, reacts to last week’s jump

- It continues to hover a tad above its 100-day SMA

- Most momentum indicators tentatively support the ongoing upleg

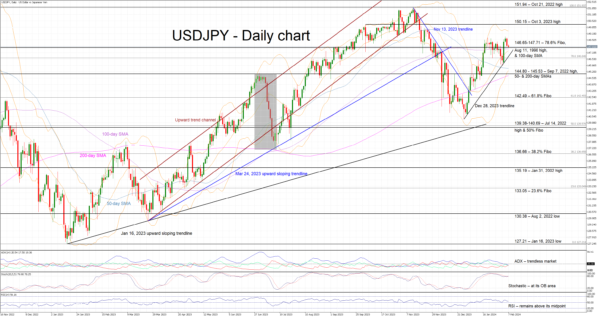

USDJPY is recording its second consecutive red candle, recouping a good part of last week’s strong gains. USDJPY continues to trade above the busy 146.65-147.71 area with the 100-day simple moving average (SMA) acting as a main support factor. The upward move since the December 28, 2023 trough remains comfortably in place.

In the meantime, the momentum indicators appear mostly supportive of the current upleg. The RSI continues to trade above its 50-midpoint and, more importantly, the stochastic oscillator remains stuck at its overbought territory. A move below this area could be seen as a strong bearish signal. On the flip side, the Average Directional Movement Index (ADX) appears uninterested in the recent moves and it is hovering in trendless territory.

Should the bulls remain hungry, they could try to stage another rally with the October 3, 2023 high at 150.15 possibly being the first target. Even higher, the October 21, 2022 high at 151.94 could be tested, opening the door for a new 30-year high.

On the flip side, the bears are probably keen to push USDJPY below the 146.65-147.71 area, which is populated by the 78.6% Fibonacci retracement of the October 21, 2022 – January 16, 2023 downtrend, the August 11, 1998 high and the 100-day SMA. If successful, the bears could then lead USDJPY towards the 144.80-145.53 region. This appears to be a key support area and would probably prove stronger to overcome than currently envisaged.

To sum up, USDJPY bulls took advantage of the recent US data releases, but they need stronger support from the momentum indicators to push the pair even higher.