- USDJPY trades sideways after failing to extend its breakout

- RSI and MACD are hovering in their positive regions

- Stochastic indicates overstretched market

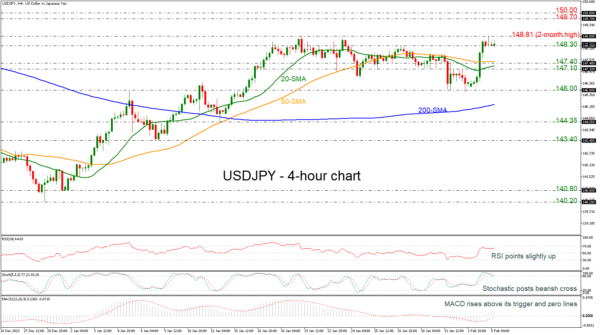

USDJPY came close to breaking the 148.81 level in the preceding week, recording a two-month high. According to the RSI, the market could maintain positive momentum in the short-term as the indicator is positively sloped near the 70 level and the MACD is extending its bullish movement above its trigger and zero lines. However, the fast Stochastics suggest that the market is located in overbought territory and therefore some weakness is possible; the %K posted a bearish crossover with the %D line.

On the upside, the price could attempt to overcome the 148.81 barrier and retest the 149.70-150.00 area, taken from the peaks in November 2023.

A reversal to the downside, on the other hand, could find immediate support at the 148.30 zone before hitting the 50-period simple moving average (SMA) at 147.70 in the 4-hour chart, ahead of 147.10. If the latter fails to halt bearish movements, the next target could be the 146.00 psychological mark.

Turning to the bigger view, the outlook has been neutral over the past three weeks and only a decisive close above 148.81 could resume the bullish picture. On the other hand, a significant decline below the 200-period SMA at 145.25 could shift the outlook to bearish.