- Japan’s benchmark index attempts to regain positive footing

- 37,000 level is still in sight

- But bullish momentum may not be strong enough

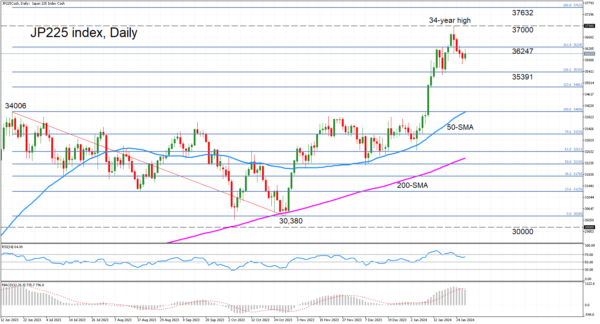

The Japan 225 stock market index (cash) edged up on Monday, heading towards the 161.8% Fibonacci extension of the June-October 2023 downtrend at 36,247. Overcoming this barrier is crucial to being able to have another go at reclaiming the 37,000 level after coming just shy of it last week when it briefly hit a 34-year high of 36,991.

The positive momentum has waned following the pullback from that top, but the bulls have not given up yet. The RSI is ticking higher today just below the 70 level, while the MACD appears to be stabilizing slightly below its red signal line and remains not too far from last week’s peak.

If the price is able to jump above the 161.8% Fibonacci, the 37,000 mark is bound to be the next target on the upside. A climb above it would reinforce the medium-term uptrend, bringing into scope the 200% Fibonacci extension of 37,632.

However, if today’s rebound falters, the bears are likely to regain the upper hand, pulling the price down to the 138.2% Fibonacci extension of 35,391 initially. Should this support fail, the focus would probably turn to the 50-day simple moving average (SMA) in the 34,000 area. Any further decline that takes the price below the 50-day SMA would risk shifting the positive outlook to neutral.

In brief, there is some hope that a fresh 34-year high can still be achieved in the near term if the index can recover above the 161.8%. Otherwise, the downside correction may extend until the 50-day SMA, endangering the bullish structure.