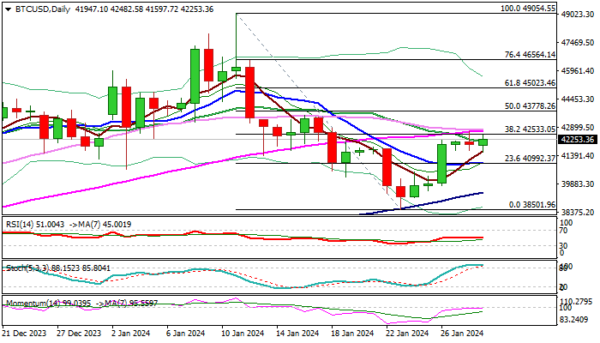

Narrow sideways mode extends into third consecutive day after recovery from two-month low (38501 of Jan 23) showed signs of stall at key resistance zone (42500).

The price action is on track to form the third straight daily Doji candle which points to strong indecision and contributes to signals that corrective phase might be over.

Daily studies remain bearishly aligned as 14-d momentum is still in negative territory, stochastic turned south in overbought zone, though MA’s are in mixed setup.

However, more evidence is needed to signal fresh direction, with dip and close below 10DMA (41036) to generate reversal signal and shift focus to the downside foe renewed probe through key supports at 40000/39000 zone.

Alternatively, sustained break of 42500/42700 zone would signal bullish continuation, which will be confirmed on lift and close above daily cloud top (43173).

Res: 42533; 42754; 43173; 43778

Sup: 41597; 40992; 40000; 39392