The Canadian Dollar faces a confluence of challenges, from the unexpected BoC stance on interest rates to mixed economic data and the traditionally impactful fluctuations in oil prices. As investors grapple with uncertainty regarding future monetary policy directions and the resilience of various economic sectors, the ‘Loonie’ is navigating a complex landscape. Understanding the interplay of these factors is crucial for anticipating the trajectory of the Canadian Dollar in the coming weeks and months.

GBPCAD – D1 Timeframe

GBPCAD on the daily timeframe seems to have just completed its fourth rejection from the trendline resistance, setting the tone for bearish movement. The confluences for this trade include; the trendline resistance, supply zone, 88% of the Fibonacci, and the previous break of structure being a bearish one. In this case though, my target is quite short so I can wait to see if the trendline support gets broken or not.

Analyst’s Expectations:

- Direction: Bearish

- Target: 1.69257

- Invalidation: 1.72251

USDCAD – H4 Timeframe

USDCAD is currently resting on the support trendline with a demand zone in sync, even though the higher timeframe suggests a bearish trend. This kind of instance reinforces the need for patience and additional confirmations, which is why despite my overall bearish sentiment, I would rather wait to see a clear break and retest of the trendline before I swing into the trade.

Analyst’s Expectations:

- Direction: Bearish

- Target: 1.32696

- Invalidation:1.35357

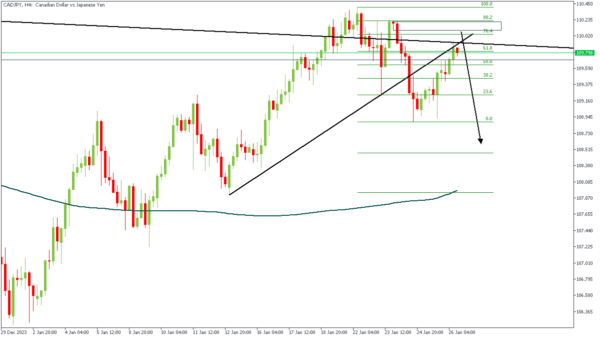

CADJPY – H4 Timeframe

CADJPY as seen has already broken the trendline after being rejected from the overall supply zone. Following this, I have marked out the Fibonacci retracement levels because I was waiting patiently for the retest, which seems to be ready now. The confluence of trendlines, Fibonacci retracement level, supply zone, and the higher timeframe trend are my confirmations for the bearish sentiment.

Analyst’s Expectations:

- Direction: Bearish

- Target: 108.673

- Invalidation: 110.419

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.