- AUDUSD recovers after hitting 0.6525

- But the bulls struggle below key resistance crossroads

- This increases the chances for another strike by the bears

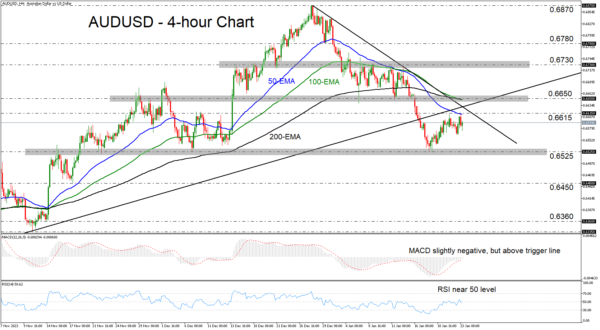

AUDUSD entered a recovery mode after it hit support near the key zone of 0.6525. However, the bulls seem to be struggling to overcome the 0.6615 level and the 50-period EMA, with the pair staying below the prior uptrend line drawn from the low of October 26, and below a short-term term downside resistance line taken from the high of December 28. This means that the bears may still be hiding behind the bushes, waiting for the perfect time to attack.

The short-term oscillators corroborate the notion that the bulls have not gained full control yet. The RSI continues to oscillate around its equilibrium 50 line, while the MACD, although above its trigger line, remains slightly negative and is showing signs that it could turn south again soon.

If indeed the bears jump into the action again soon, they may initially dive towards the 0.6525 zone, the break of which would confirm a lower low and perhaps allow declines all the way down to the 0.6450 area, defined as support by the low of November 17.

For the short-term outlook to brighten, the pair may need to climb above the 0.6650 zone. This would confirm the upside violation of both the aforementioned diagonal lines and also take the pair above all three of the plotted EMAs. The bulls may then get encouraged to march towards the 0.6730 territory, which has been acting as a ceiling since the beginning of the year.

Recapping, AUDUSD recovered decently last week, but the advance remained limited below a prior uptrend line, suggesting that the bears could still attempt an attack anytime soon.