- ECB faces a communication challenge in first meeting of the year

- Timing of rate cut likely to dominate discussion, but hawks to resist

- Mixed messages unhelpful to euro ahead of the decision on Thursday (13:15 GMT)

- Flash PMIs on Wednesday (11:00 GMT) on the agenda too

Progress on inflation may be slowing

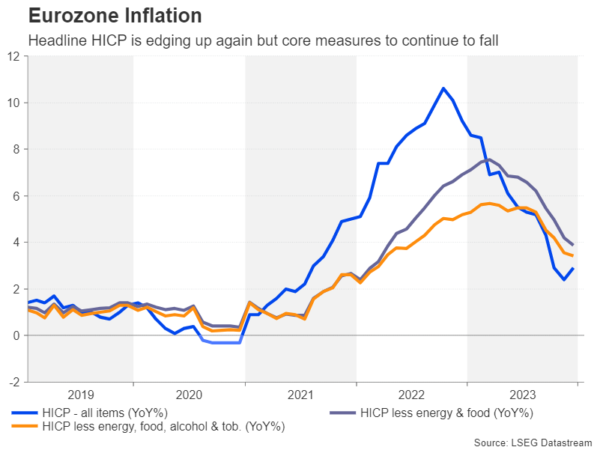

After inflation shot up to double digits in 2022, it’s fair to say that 2023 has been a more successful year for the European Central Bank. The annual rate of change in the Eurozone’s Harmonised Index of Consumer Prices (HICP) started the year at 8.6%. By December, it had fallen to 2.9%.

However, this was an uptick on November’s figure of 2.4%, marking the first increase since April. Policymakers expect this unwelcome reversal to continue in the first few months of 2024. With last year’s plunge in energy prices slowly dropping out of the calculations and energy subsidies across the bloc being phased out, HICP will likely soon pop back above 3.0%.

On the bright side, underlying inflation in the euro area has maintained its downward trajectory, so policymakers are reasonably confident that inflation is well on its way to hit their 2% target by 2025.

ECB wary of upside risks to inflation

There are risks, however. Wage growth in the Eurozone remains elevated despite sluggish economic growth. President Christine Lagarde has hinted that how the wage landscape evolves by late spring will be crucial to any decision on policy easing. But perhaps a bigger threat in the fight against inflation is the latest crisis in the Middle East.

The attacks by Houthi rebels on vessels passing through the Red Sea have intensified to the extent that many companies are suspending shipping through this route, instead rerouting ships around the Horn of Africa. This significantly increases the cost for European businesses importing goods from Asia. Without a de-escalation of tensions in the region, this temporary supply shock could turn into a major headache for the ECB.

Flash PMIs eyed as Eurozone on verge of recession

It’s likely therefore that policymakers will maintain their data-dependent approach on Thursday, while repeating that “policy rates will be set at sufficiently restrictive levels for as long as necessary”. In the absence of fresh macroeconomic projections at the January meeting, investors will turn to Lagarde’s press briefing at 13:45 GMT for an updated view on the economy and the inflation outlook.

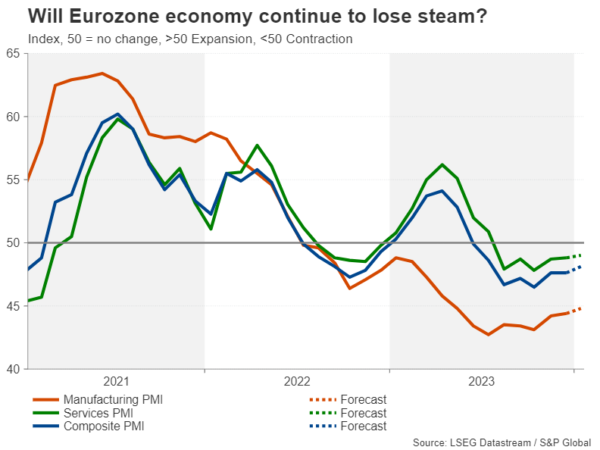

Recession risks have heightened again lately for the euro area, as business activity has failed to pick up substantially from the summer dip. The PMI surveys suggest Eurozone GDP is headed for a second consecutive quarter of contraction in the final three months of 2023. The flash readings for January are due a day before the ECB meeting and should they point to more misery for businesses at the start of the new year, the euro will probably go into the ECB decision on the backfoot.

Can euro’s uptrend stay intact?

Gloomy PMI numbers and a not-so-hawkish tone by Lagarde would potentially be the worst outcome for the single currency this week. The euro could breach its medium-term ascending trendline in such a scenario, which would set the stage for a test of the 50.0% and 61.8% Fibonacci retracement levels of this upleg at $1.0793 and $1.0711, respectively.

Alternatively, if Lagarde draws attention to June as the earliest time when policymakers will have enough data to consider whether rates should be cut, euro/dollar could stabilize around its 200-day moving average (MA) in the $1.0845 region. But for the pair to recover, Lagarde would need to additionally throw cold water on the prospect of the ECB slashing rates by anywhere near as much as what markets have priced in. Even after the latest pushbacks, cumulative bets for 2024 stand at 130 basis points. An improvement in the PMIs would also be essential for a euro rally.

Any rebound in euro/dollar could stretch towards the December peak of $1.1139, with obstacles likely to be found at the 50-day MA near $1.0920 and the 23.6% Fibonacci of $1.0976.

Davos deals a blow to dovish bets

ECB officials attending the World Economic Forum in Davos last week signalled they’re open to rate cuts in the summer if inflation stays on the right path, with Lagarde throwing her weight behind this timeline too. The more hawkish members of the Governing Council have been somewhat more reluctant to commit to a specific timeframe. But what is increasingly certain is that any hope of a March pivot has been dashed, and until the ECB is ready to flag its first rate cut, the euro could end up drifting sideways.