- AUDUSD fails to fall below 0.6645

- Price holds well above uptrend line

- RSI is flattening

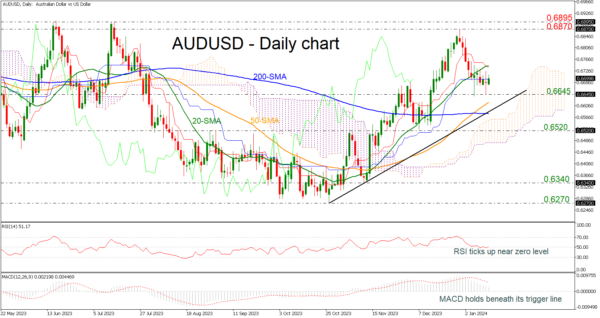

AUDUSD has been in a somewhat positive corrective mode during the week, earning back some losses from the December 28 high of 0.6870.

Entering the 0.6700 area has been a struggle over the past few days, and there might be another tough obstacle within the 0.6740 region, which is the 20-day simple moving average, but the bulls may not give the battle yet according to the technical indicators. Specifically, the RSI is moving horizontally near the 50 level, while the MACD is still in the positive area but with weaker momentum than before.

In the event the pair re-activates its uptrend above 20-day SMA at 0.6740, the next target will be the 0.6870 region and then the 0.6895 barrier, taken from the peak on July 14.

On the downside, the 0.6645 support has been guarding selling forces over the last five days. Hence a step beneath that line at the 50-day SMA at 0.6615 might produce a fresh bearish wave, likely squeezing the price towards the 200-day SMA at 0.6580, which overlaps with the medium-term ascending trend line. Another defeat there could add more fuel to the negative move, bringing the 0.6520 support immediately under the spotlight.

Overall, AUDUSD has been sustaining an upward trend since October 2026 in the daily picture. To attract new buyers, the pair will need to pierce through the 0.6870 bar.