- USDCHF’s rebound is not convincing yet

- A continuation above 20-SMA could boost sentiment

- US nonfarm payrolls report due at 13:30 GMT

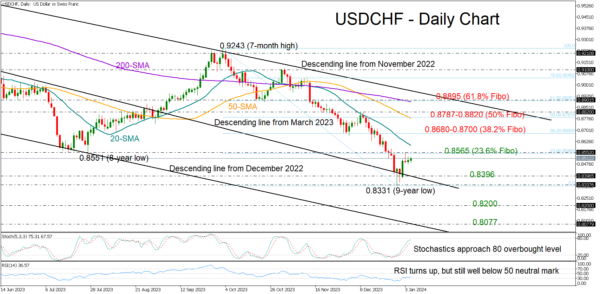

USDCHF is set to close the first week of the year within the positive area, having secured a strong foothold around the support-turned-resistance trendline from March 2023 at 0.8400 following the flash drop to an almost nine-year low of 0.8331.

That said, the latest upturn in the price hasn’t gained credence yet as the constraining 23.6% Fibonacci retracement of the October-December 2023 downleg could still cap bullish forces around 0.8565 along with the 20-day simple moving average (SMA). The technical signals are reflecting some caution as well. The stochastic oscillator has risen closer to its overbought levels, whilst the RSI, although stronger, is comfortably below its 50 neutral mark.

If the recovery continues above the 20-day SMA at 0.8600, the bulls could advance towards the 38.2% Fibonacci of 0.8680 and the 0.8700 psychological level. Moving higher, they might next challenge the 50-day SMA and the 0.8787-0.8820 region, where the pair peaked in December.

Alternatively, a downside correction could initially pause somewhere between the falling trendline at 0.8396 and December’s low of 0.8331. If that floor cracks, the downtrend could examine the 0.8200 round level before stretching towards the support line from December 2022 at 0.8077.

In brief, USDCHF seems to have found an ideal place for a rebound, though buyers would like a confirmation above the 20-day SMA and the 0.8600 number to drive it higher.