- USDCAD is recovering following December nosedive

- Positive momentum is gaining traction but sustained rebound not certain yet

- Is this just a temporary respite?

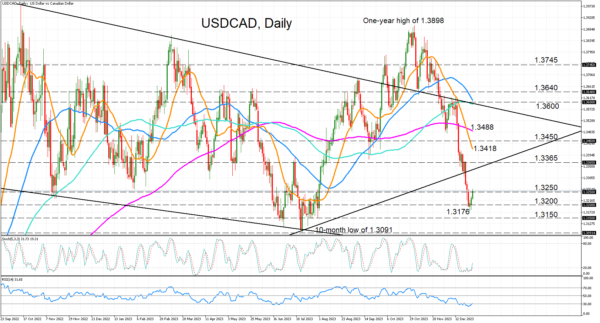

USDCAD is headed for a third straight day of gains as it recovers from Wednesday’s five-month low of 1.3176. The pair’s two-month old slide accelerated in mid-December, pushing the momentum indicators deep into oversold territory.

But the bearish pressures have started to ease, with the immediate bias turning positive, as both the stochastics and RSI are attempting to exit their oversold zones. However, there is some way to go before a clearer picture of a durable recovery starts to emerge.

The pair is testing the congestion region of 1.3250 today. A daily close above this level followed by a break above the next hurdle of 1.3365 would provide more tenacity to the bulls. But ideally, the price would need to climb to at least above the 20-day simple moving average (SMA), currently located at 1.3418, for the rebound to become more sustainable. If successful, this would lay the groundwork for a push towards the 1.3600 area where the 50- and 100-day SMAs are about to intersect.

However, if the bullish momentum fades and the price reverses lower, the 1.3200 level is the nearest and only support preventing USDCAD from resuming its medium-term downtrend. A drop below 1.3200 would clear the path for the 1.3150 area before revisiting the July trough of 1.3091.

In brief, this week’s bounce for USDCAD is still in its infancy and for the short-term picture to improve convincingly, the bulls need to reclaim the 20-day SMA. Otherwise, the pair could be headed for fresh lows.