- GBPJPY moves without direction in the past two weeks

- The 50- and 200-day SMAs curb upside and downside, respectively

- RSI and MACD are deep in their negative zones

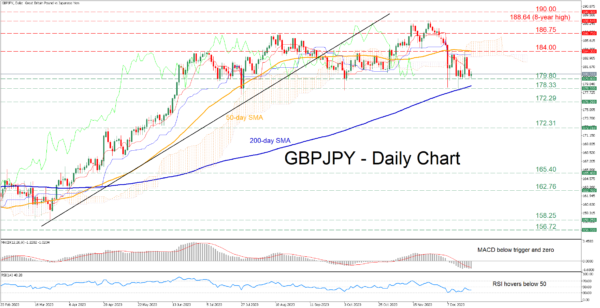

GBPJPY had been in a prolonged uptrend since January, posting an eight-year high of 188.64 on November 24 before experiencing a pullback. In the short-term, the pair is undergoing a period of rangebound trading, with its 50- and 200-day simple moving averages (SMAs) defining its neutral pattern.

Considering that the short-term oscillators remain tilted to the downside, the price could inch lower to test the recent support of 179.80. If that hurdle fails, the spotlight could turn to the December bottom of 178.33, which also held strong in October and lies very close to the 200-day SMA. Even lower, the July low of 172.29 might cap the pair’s downside.

Alternatively, should the pair reverse back higher, immediate resistance could be met at the 50-day SMA of 184.00, which rejected two upside attempts in December. Piercing through that wall, the price may challenge the August high of 186.75. A violation of that region could open the door for the eight-year peak of 188.64.

In brief, GBPJPY retains a muted tone in the past few sessions as the efforts to escape its range in both directions have been disproved. Is the pair already in a consolidation phase?