- USDCHF tests July’s eight-year low

- Sellers might stay in power, but not for long

- Core PCE inflation due at 13:30 GMT

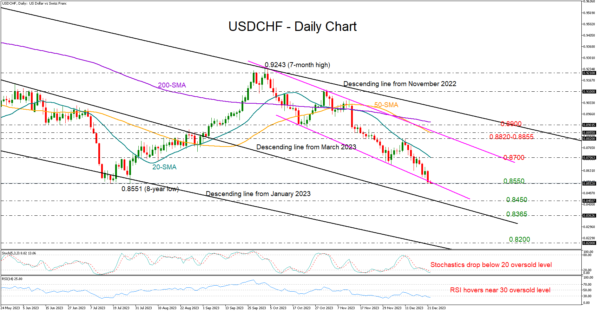

It was another bearish week for USDCHF, with the price fully retracing its July-September upleg to reach July’s eight-year low of 0.8551.

There is potential for an upside reversal around the 2023 floor of 0.8550. However, the RSI and the stochastics have yet to bottom out in the oversold region, suggesting the sellers might stay in play for a bit longer.

The 0.8450 region, where the broken descending trendline from March 2023 is positioned, could generate fresh buying ahead of the important January 2015 support area of 0.8365. If the latter proves fragile, the sell-off could pick up steam to meet the 2015 low of 0.8200 and the falling line from January 2023.

Should the price rotate higher near 0.8550, the spotlight will turn again to the constraining 20-day simple moving average (SMA) at 0.8700, which blocked the way up earlier this month. A successful penetration higher could then retest December’s high of 0.8820 ahead of the 50-day SMA at 0.8855, while a more aggressive bullish wave could challenge the 200-day SMA near 0.8900.

In short, USDCHF keeps facing downside risks near a critical support area, though it is also trading within oversold territory, increasing hopes for a bullish correction.