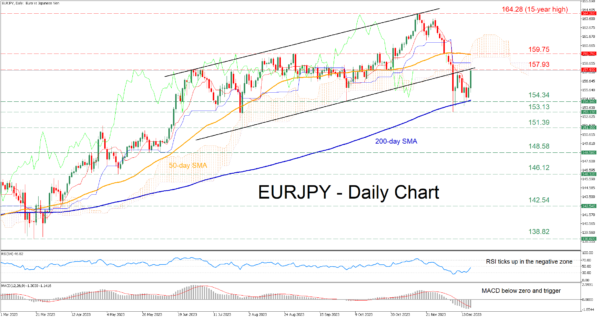

- EURJPY falls sharply but the 200-day SMA acts as a strong floor

- Repeated failure to violate the latter triggers an upward spike

- Momentum indicators improve, but remain in negative zones

EURJPY had been experiencing a steep pullback from its recent 15-year peak of 164.28, which ceased at the crucial 200-day simple moving average (SMA). In today’s session, the pair has gained significant ground in its attempt to erase the recent correction.

Should buying pressures intensify further, the June-July resistance of 157.93 could prove to be the first barricade for the bulls to claim. A break above that area could pave the way for the August resistance of 159.75, which overlaps with the 50-day SMA. Failing to halt there, the pair might revisit its 15-year high of 164.28.

On the flipside, if the pair reverses back lower, the congested region that includes the 200-day SMA and the October-December support of 154.34 could act as the first line of defence. Sliding beneath that floor, the price may test its December bottom of 153.13, which is also its lowest level in four months. Further retreats could cease around the July low of 151.39.

In brief, EURJPY managed to pause its short-term selloff with some help from the 200-day SMA. However, for the bulls to regain confidence, the price has to reclaim the 157.93 hurdle.