Key Highlights

- USD/JPY extended losses below the 142.50 support.

- A crucial bearish trend line is forming with resistance at 145.20 on the 4-hour chart.

- EUR/USD and GBP/USD surged after the Fed’s dovish stance.

- The US Manufacturing PMI could decline from 49.4 to 49.3 in Dec 2023 (Preliminary).

USD/JPY Technical Analysis

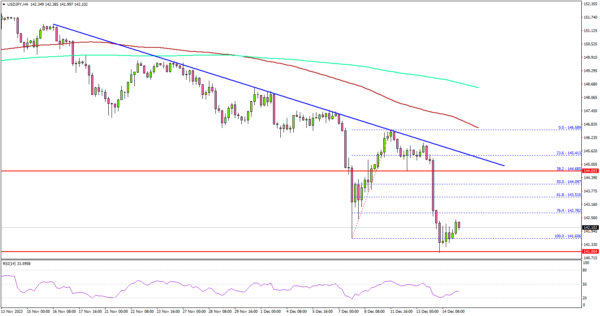

The US Dollar remained in a bearish zone below the 145.00 level against the Japanese Yen. The Fed’s dovish outlook and possible rate cuts in 2024 sparked bearish moves in USD/JPY.

Looking at the 4-hour chart, the pair gained bearish momentum below the 143.50 support zone. It even settled below the 143.00 level, the 100 simple moving average (red, 4 hours), and the 200 simple moving average (green, 4 hours).

The pair accelerated lower below the 142.80 support zone. It seems like the bears are aiming for a move toward the 140.00 support zone.

The next major support is 138.80, below which the bears might aim for 136.20. On the upside, immediate resistance is near the 142.80 level. The next key resistance is near the 143.50 level.

The main resistance is near 145.00. There is also a crucial bearish trend line forming with resistance at 145.20 on the same chart. A close above the 145.00 zone could open the doors for more upsides. The next stop for the bulls might be 147.40.

Looking at EUR/USD, the pair found support and started a major upward move above the 1.0920 resistance zone.

Economic Releases

- Euro Zone Manufacturing PMI for Dec 2023 (Preliminary) – Forecast 44.6, versus 44.2 previous.

- Euro Zone Services PMI for Dec 2023 (Preliminary) – Forecast 49.0, versus 48.7 previous.

- UK Manufacturing PMI for Dec 2023 (Preliminary) – Forecast 47.5, versus 47.2 previous.

- UK Services PMI for Dec 2023 (Preliminary) – Forecast 51.0, versus 50.9 previous.

- US Manufacturing PMI for Dec 2023 (Preliminary) – Forecast 49.3, versus 49.4 previous.

- US Services PMI for Dec 2023 (Preliminary) – Forecast 50.6, versus 50.8 previous.