- EURJPY pauses sharp downfall near 200-day SMA

- Oversold, but trend signals remain discouraging

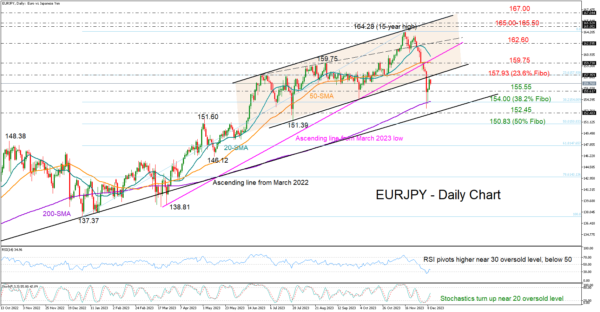

EURJPY turned oversold near its 200-day simple moving average (SMA) after a heavy bearish storm squeezed the pair from fifteen-year highs to a four-month low of 153.00 last week.

The latest freefall in the price has breached the June-November bullish channel, charting a new lower low in the short-term picture. Hence, traders may stay cautious, although the RSI and the stochastic oscillators have changed direction to the upside, backing the latest upturn in the price.

The pair faced difficulty in re-entering the broken upward-sloping channel on Monday at 157.93. That is where the 23.6% Fibonacci mark of the 2023 uptrend is also positioned. Therefore, a close above that bar could be important for a continuation towards the 50-day SMA at 159.75. The 20-day SMA is within breathing distance and if it proves easy to pierce through, the recovery could next take a breather around the short-term constraining line from June at 162.60 before reaching November’s highs.

Otherwise, the pair could enter a consolidation phase. The 155.55 region and the 200-day SMA, which intersects the 38.2% Fibonacci of 154.00, could keep the bears in control. If the outlook deteriorates below the ascending line from March 2022 at 152.45, selling pressures could drive the pair towards the 50% Fibonacci of 150.83.

All in all, the latest sell-off in EURJPY raised concerns about a bearish trend reversal. Downside risks could ease if the price manages to bounce back above 157.93.