Key Highlights

- GBP/USD started a downside correction from the 1.2732 zone.

- It traded below a key bullish trend line with support at 1.2640 on the 4-hour chart.

- The UK Claimant count could change by 20.3K in Nov 2023, up from 17.8K.

- The US CPI could decline further to 3.1% in Nov 2023 (YoY) from 3.2%.

GBP/USD Technical Analysis

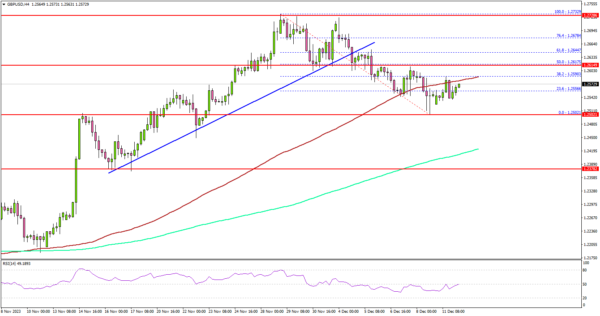

The British Pound faced sellers near the 1.2735 zone against the US Dollar. GBP/USD started a downside correction and traded below the 1.2650 support.

Looking at the 4-hour chart, the pair traded below a key bullish trend line with support at 1.2640. There was a spike below the 100 simple moving average (red, 4 hours) and 1.2550.

However, the bulls were active above the 1.2500 level. A low was formed near 1.2502 and the pair is now consolidating losses and trading well above the 200 simple moving average (green, 4 hours). On the upside, immediate resistance is near the 1.2620 level.

The 50% Fib retracement level of the recent decline from the 1.2732 swing high to the 1.2502 low is also near 1.2620. The next key resistance is near the 1.2640 level.

The main resistance is near 1.2670. A close above the 1.2670 zone could open the doors for more upsides. The next stop for the bulls might be 1.2740.

If there is another decline, the pair might find support near the 1.2500 level. If there is a downside break below the 1.2500 support, the pair could drop toward the 1.2450 level. The next major support is 1.2420, below which the bears might aim for 1.2300.

Looking at EUR/USD, the pair declined heavily toward 1.0740 and there is a risk of more downsides in the near term.

Economic Releases

- UK Claimant Count Change for Nov 2023 – Forecast 20.3K, versus 17.8K previous.

- UK ILO Unemployment Rate for Oct 2023 (3M) – Forecast 4.2%, versus 4.7% previous.

- US Consumer Price Index for Nov 2023 (MoM) – Forecast +0.1%, versus 0% previous.

- US Consumer Price Index for Nov 2023 (YoY) – Forecast +3.1%, versus +3.2% previous.

- US Consumer Price Index Ex Food & Energy for Nov 2023 (YoY) – Forecast +4%, versus +4% previous.