Gold remains in red for the second consecutive day and fell below $2000 early Monday, pressured by firmer dollar on solid US labor data.

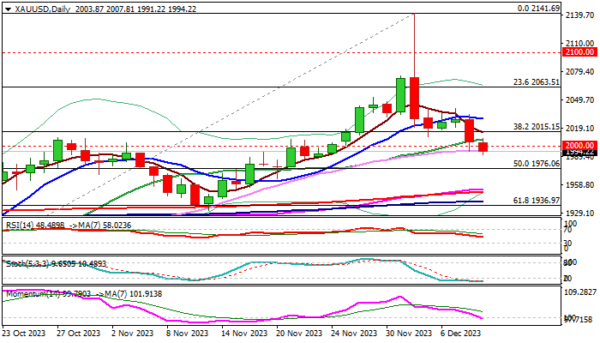

Friday’s 1.2% drop generated fresh bearish signal on close below $2015 pivot (Fibo 38.2% of $1810/$2141), with extension lower adding to the strength of bearish continuation signal.

Near-term technical picture is weakening, as 14-d momentum is breaking into negative territory and 10/20 DMA’s turned to bearish configuration, although oversold conditions may produce headwinds and possibly slow bears.

Pullback from new all-time high ($2141, Dec 4 spike) could be seen for now as a healthy correction ahead of fresh push higher, as the correction is still within the limits, but could also signal reversal, after bears broke pivots at $2015/$2000 and look for confirmation on loss of $1976 (50% retracement of $1810/$2141).

Traders eye US inflation report and Fed policy decision, which could provide stronger direction signal.

The yellow metal may accelerate high if US inflation comes below expectations in November, with additional positive signal to be generated from Fed, as the central bank is widely expected to keep interest rates unchanged and stronger signals about rate cuts would deflate dollar.

Res: 2000; 2015; 2041; 2063.

Sup: 1990; 1976; 1955; 1951.