- GBPJPY reverses October-November rally

- Oversold conditions detected after sharp drop

- Resistance at 181.45-182.00

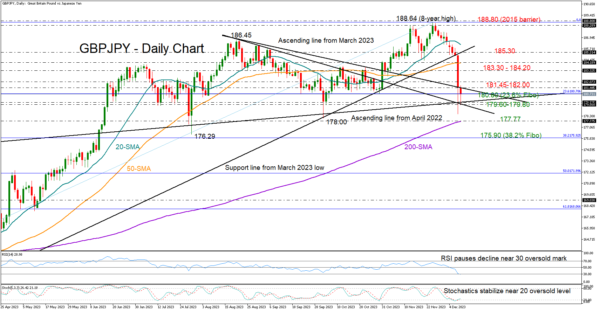

GBPJPY crashed by 3.5% to 178.51 on Thursday before closing the day at 181.45, marking its worst daily session of the year. The pair faced heavy selling in the wake of renewed signals the Bank of Japan could exit its existing super accommodative monetary policy.

The bears are currently aiming to push the price back below the 180.00 mark, but the RSI and the stochastic oscillators have already plunged into oversold waters, suggesting selling pressures could fade soon.

The 23.6% Fibonacci retracement level of the 2023 uptrend is slightly lower at 180.80 and could help the pair to crawl back above the nearby resistance of 181.45 and the 182.00 round level. Running higher, some consolidation could develop between the 183.30 barrier and the 50-day simple moving average (SMA) at 184.20. If the recovery continues, the bulls will attempt to climb back above the broken support trendline at 185.30 and perhaps cross above the 20-day SMA at 186.16 too.

Alternatively, a step below 180.80 could initially stabilize within the 179.60-179.80 region, where the ascending line from April 2022 intersects the short-term restrictive lines from August. A defeat there could open the way towards the 200-day SMA at 177.77. Beneath that, sellers could head for the 38.2% Fibonacci of 175.90.

In a nutshell, GBPJPY could heal some of its wounds following its latest freefall. A clear move above 181.45-182.00 could strengthen upside forces.