Key Highlights

- Gold prices rallied toward $2,150 before a downside correction.

- It broke a key bullish trend line with support near $2,035 on the 4-hour chart.

- Crude oil prices extended losses and traded below the $72.00 support.

- EUR/USD failed to stay above the key 1.0820 support.

Gold Price Technical Analysis

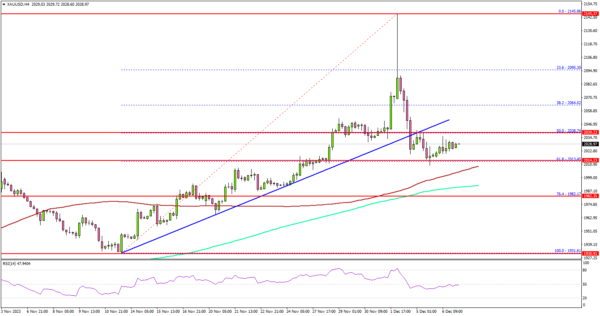

Gold rallied above the $2,000 and $2,050 resistance. It even spiked toward $2,150 before the bears appeared. A high was formed near $2,145 and the price corrected lower.

The 4-hour chart of XAU/USD indicates that the price declined heavily below the $2,120 and $2,100 levels. It broke a key bullish trend line with support near $2,035.

The bears were able to push the price below the 50% Fib retracement level of the upward move from the $1,931 swing low to the $2,145 high. The price is now testing the $2,010 support and trading above the 100 Simple Moving Average (red, 4 hours).

The 61.8% Fib retracement level of the upward move from the $1,931 swing low to the $2,145 high is also acting as a support. The next major support could be $1,985 or the 200 Simple Moving Average (green, 4 hours). Any more losses might call for a move toward the $1,960 level.

On the upside, the price is facing resistance near $2,040. An upside break above the $2,040 level could send the price soaring toward the $2,080 resistance. The next major resistance is near the $2,095 level, above which Gold could test $2,120.

Looking at crude oil, the bears remained in action, and they were able to push the price below the $72.00 support.

Economic Releases to Watch Today

- US Initial Jobless Claims – Forecast 222K, versus 218K previous.