- GBPUSD finds strong resistance near 200-week EMA

- Technical signals are negative

- Will 2024 be a negative year for the pair?

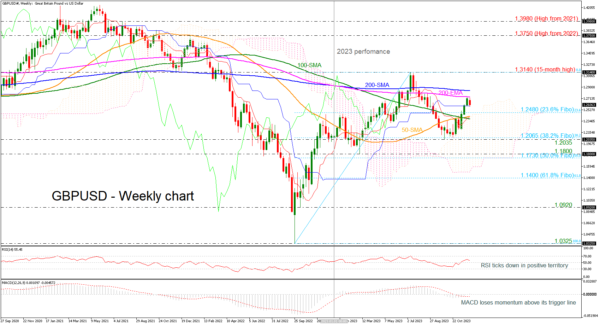

With the year 2023 drawing to a close, GBPUSD could not carry the impressive rally of the last three weeks above the bullish crossover within the 50- and the 100-week simple moving averages (SMAs) and the 23.6% Fibonacci retracement level of the upward wave from 1.0325 to 1.3140 at 1.2480. Also, the pair found strong resistance near the 200-week exponential moving average (EMA), sending prices lower this week so far.

Currently, the market price is holding above the opening price from last January. However, the technical oscillators are suggesting a weakening momentum. Specifically, the RSI is pointing south in the bullish region, while the MACD is flattening above its trigger line and near the zero level.

The market structure is positive in the long-term picture as the pair keeps fluctuating within a bullish territory. Hence, even if downside pressures resume, the pair will remain attractive unless it exits the bullish formation below the 38.2% Fibonacci of 1.2065. If that bearish scenario unveils, selling forces could intensify towards the 1.1800 mark and the 50.0% Fibonacci of 1.1730. Then, additional losses from there could test the 61.8% Fibonacci of 1.1400.

In the event the price stays resilient above the 200-week EMA and the 200-week SMA, the bulls might push for a close above the 15-month high of 1.3140. Therefore, a successful move higher could immediately shift the attention to the 1.3750 barricade, registered in 2022.

In a nutshell, GBPUSD may remain supported in the coming sessions, especially if it jumps beyond the immediate moving averages. However, a bearish round cannot be excluded from the table as the oscillators suggest a bearish structure in the near future.