- EURCHF surges to a 1-month high

- Momentum indicators suggest more bullish movement

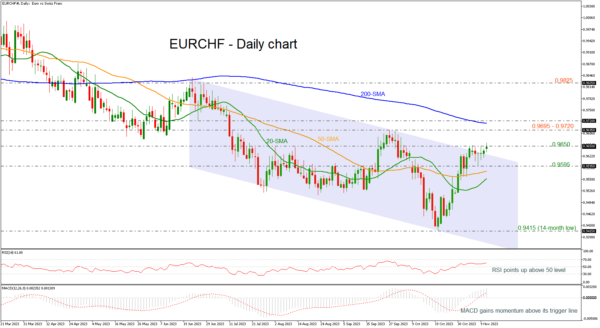

EURCHF is probably set for another bullish wave as the price is jumping above the 0.9650 significant resistance and the five-month bearish channel. The pair recorded a new one-month high of 0.9660 earlier today.

The 20- and the 50-day simple moving averages (SMAs) are ready for a positive crossover in the next few sessions with the technical oscillators showing some encouraging signs too. The RSI is still developing above the neutral threshold of 50 and is pointing upwards, while the MACD is rising above its trigger and zero lines, indicating that buyers still have momentum.

Should upside pressures persist, the area within 0.9695-0.9720 could initially attract traders’ attention as it also encapsulates the 200-day SMA around 0.9712, in the short-term timeframe. Conquering this barricade, the bulls might aim at the 0.9825 peak, taken from the highs on June 28.

On the flipside, bearish actions could send the price lower to test the previous bottom at 0.9595 and the 50- and the 20-day SMAs at 0.9580 and 0.9560, respectively. Sliding beneath these support lines, the spotlight would turn to the 14-month low of 0.9415.

All in all, EURCHF seems to be experiencing upside pressure after the bounce off the 0.9415 bottom, raising the odds of a fresh bullish rally.