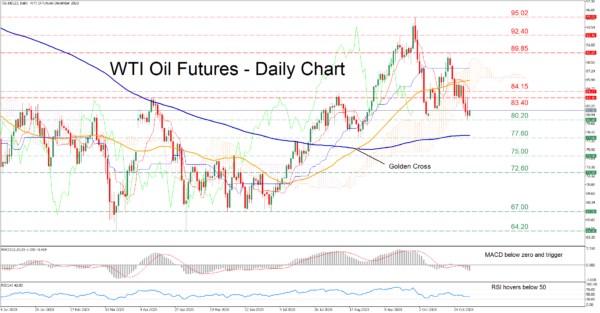

- WTI futures decline after rejection at 50-day SMA

- Found their feet around the 80.00 handle, forming potential double bottom

- Momentum indicators deep in the negative zone

WTI oil futures (December delivery) have been on the retreat since their October peak of 89.85. In the near term, the price’s repeated inability to conquer the 50-day simple moving average (SMA) led to an acceleration of the decline and a fall below the Ichimoku cloud.

Should the bears try to push the price lower, initial support could be met at 80.20, which held strong twice in October. A break below that zone could pave the way for the August low of 77.60 that lies very close to the 200-day SMA. Further declines could then come to a halt at the June resistance of 75.00.

Alternatively, if the price manages to reverse its retreat, the April high of 83.40 could prove to be the first obstacle for the bulls to reclaim. Piercing through that wall, the price may then challenge the August peak of 84.15. Should that barricade also fail, there is no prominent resistance ahead of the October rejection region at 89.85.

In brief, WTI oil futures managed to pause the latest decline for now, but the short-term oscillators remain heavily tilted to the downside. However, the rebound could become more convincing in the case of a double bottom formation.