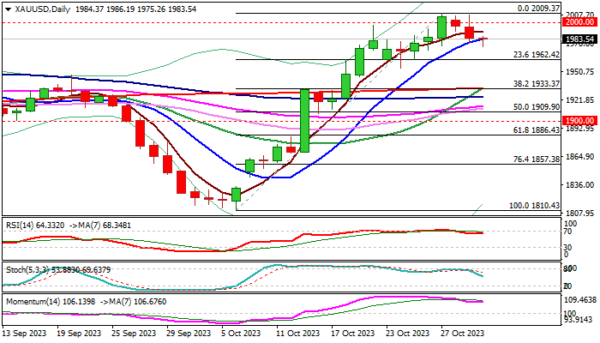

Gold remains at the back foot for the third consecutive day, following another failure to sustain gains above psychological $2000 level.

Yellow metal ‘s price hit new multi-month high at $2009 last Friday, but subsequent return below $2000 points to persisting headwinds at this zone.

Gold rallied strongly in October (up 7.3%) driven by strong safe-haven demand after the conflict in Middle East started, adding to already fragile geopolitical situation and prompting investors out of riskier assets.

Dips were so far shallow and contained by rising daily Tenkan-sen / broken Fibo 61.8% of $2080/$1810 downtrend ($1983/77 respectively), with ability to hold above these levels to signal limited consolidation ahead of fresh attempt higher.

Deeper pullback, however, should find firm ground at $1960/50 zone to mark a healthy correction and keep larger bulls unharmed.

Daily studies remain bullish, with current pullback so far seen as technical correction, sparked by overbought conditions.

US Federal Reserve ends its policy meeting today and the decision is expected to strongly influence metal’s price.

Wide expectations that the central bank will keep the policy unchanged would offer fresh support to gold, though, investors will be also looking for the Fed’s assessment of the US economy, which would provide more clues about central bank’s action in the near future.

Bullish bias expected above $1962/53 (Fibo 23.6% of $1810/$2009/Oct 24 trough) while break lower would put bulls on hold and risk attack at lower pivot at $1933 (200DMA / Fibo 38.2%).

Conversely, sustained break of $2000 zone would generate initial signal of bullish continuation and expose targets at $2009, $2048 and $2080.

Res: 1990; 2000; 2009; 2021.

Sup: 1975; 1962; 1953; 1933.