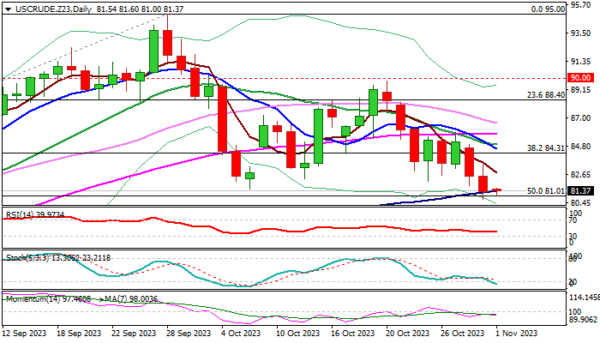

WTI oil is consolidating within a narrow range early Wednesday after almost 4% drop in past two days which cracked pivotal $81.00 support zone (100DMA (50% retracement of $67.02/$95.00 ascend.

Fresh bears faced increased headwinds in this zone, failing so far to register a clear break lower, as key factors that influence price movement are mixed.

Technical structure on daily chart is predominantly bearish (strong negative momentum / daily Tenkan-sen/Kijun-sen in bearish configuration / price holding below the base of daily cloud), while reversal pattern is developing on monthly chart after October’s close in red (the first bearish close after three-month rally and the biggest monthly loss since September 2022).

On the other hand, fundamentals continue to conflict, as record monthly oil output in the US adds pressure, along with unexpected contraction in China’s factory activity in Oct, while markets continue to closely watch developments in the Middle East.

Traders shift focus on a number of key economic data from the US today, with Oct Manufacturing PMI, reports from the labor sector (Oct ADP private sector employment and Sep JOLTS job openings) and EIA crude inventories report, to precede key event – Fed interest rate decision.

Fresh bears look for a weekly close below former higher low at $81.52 (Oct 6) to complete a failure swing pattern on daily chart and boost prospects for deeper fall.

Clear break of $81.01 (50% of $67.02/$95.00) to verify negative signal for attack at psychological $80 support and 200DMA ($78.10) in extension).

Near-term bias is expected to remain with bears while price action stays below daily cloud base ($83.98).

Res: 82.30; 82.78; 83.98; 84.31.

Sup: 81.01; 80.73; 80.00; 78.10.