Key Highlights

- EUR/USD is struggling to clear the 1.0625 resistance zone.

- It broke a key bullish trend line with support near 1.0585 on the 4-hour chart.

- Gold price surged further and surpassed the $2,000 resistance.

- GBP/USD is showing bearish signs below the 1.2200 pivot level.

EUR/USD Technical Analysis

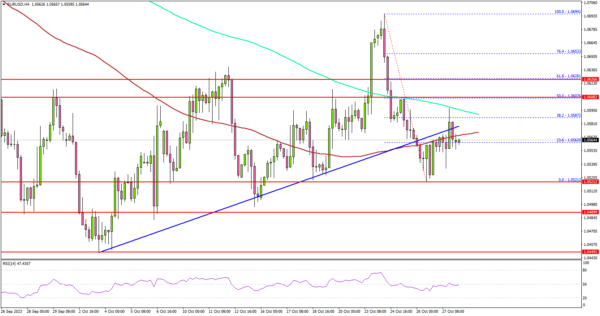

The Euro started a fresh decline from the 1.0695 zone against the US Dollar. EUR/USD traded below the 1.0620 support to enter a bearish zone.

Looking at the 4-hour chart, the pair broke a key bullish trend line with support near 1.0585. There was a spike below the 100 simple moving average (red, 4 hours). The pair settled below the 200 simple moving average (green, 4 hours).

It traded as low as 1.0521 before the bulls appeared. The pair is now consolidating losses and facing resistance near the 1.0600 zone.

On the upside, the pair might face strong resistance near the 1.0620 level. If there is a clear move above 1.0620, the pair could rise toward the 1.0650 resistance. The next key resistance is near 1.0665, above which the pair could rise toward the 1.0700 level.

If there is a fresh decline, the pair might find bids near 1.0520. The next key support is seen near 1.0500, below which it could test 1.0440. Any more losses might send the pair toward the 1.0400 level.

Looking at gold, there was a strong increase above the $1,980 resistance and the bulls even pumped it above the $2,000 barrier.

Economic Releases

- German Gross Domestic Product for Q3 2023 (QoQ) (Prelim) – Forecast -0.3%, versus 0% previous.

- German Consumer Price Index for Oct 2023 (YoY) (Prelim) – Forecast +4.0%, versus +4.5% previous.

- German Consumer Price Index for Oct 2023 (MoM) (Prelim) – Forecast +0.2%, versus +0.3% previous.